Retail Investing and Trading in Crypto

MORITZ PUTZHAMMER

03 March 2023 • 10 min read

Table of contents

In recent years, the world of finance has seen the explosive growth of the cryptocurrency ecosystem. What started out as a niche interest among tech enthusiasts has now become a mainstream investment option, with more and more people around the world starting to invest in bitcoin and altcoins.

One of the more popular ways that people have entered the crypto space is through retail trading in which investors buy and sell cryptos on a centralized exchange such as Binance. While this is often the easiest way for beginners to add crypto to their investment portfolios, it’s not with certain risks, as the FTX debacle has shown. In addition, retail crypto investors typically try to time the market through manual trading rather than using automated investment solutions such as crypto trading bots.

And then there is the issue of perceptions. Retail investing and trading in crypto continue to receive a seemingly endless amount of hype, which is to a certain extent normal given the sums of money involved in the market. When asked to imagine a crypto trader, for example, many people envision someone who spends all day tied to their computer, constantly stalking the market and using complex trading strategies to make money. In actuality, though, many crypto traders aren’t able to (or don’t want to) devote every waking minute to trading crypto.

Whether crypto, forex, or otherwise, retail trading can be difficult work, although this doesn’t necessarily have to be the case. In this article, we'll take a closer look at the world of retail trading crypto and explore why it's become such a popular way to invest in digital assets.

What is Crypto Retail Investing?

Crypto retail investing refers to the practice (or art) of individual traders investing in cryptocurrencies such as bitcoin and Ethereum via online platforms or exchanges such as Binance. The “retail” in crypto retail investing refers to individuals as opposed to institutional investors, who have traditionally dominated the world of finance.

One of the key benefits of crypto retail investing is its accessibility. With a computer or smartphone, anyone can create an account with a cryptocurrency exchange and start investing in a matter of minutes, which has democratized personal investing, providing anyone with a level of access to financial markets that was previously only available to large institutions.

Another advantage of crypto retail investing is its potential for high returns. Cryptocurrencies have experienced significant price swings, with some assets increasing in value by thousands of percent in a matter of months or even days.

Much of the philosophy behind cryptocurrency centers around breaking down the barriers around investment options, opening up viable pathways for wealth creation for essentially anyone with an internet connection and some cash. These lucrative trading opportunities are no longer reserved exclusively for the uber-rich elite, which has resulted in increasing numbers of retail crypto traders.

Who Are Retail Crypto Investors and Traders?

So who are the people investing in retail crypto trading? Well, they’re just like you and me. Some are professional traders, but most are financially and technologically literate individuals drawn to the future of money and its democratizing ethos.

Some trade with relatively small amounts of money, while others are willing to part with more of their cash. Some see crypto retail investing as a full-time occupation, while others think of it as just another piece in their overall investment portfolio. Some see retail crypto investing as a source of passive income, effectively a side hustle to increase their bottom line, while others invest in crypto only (or only bitcoin for you maxis out there).

Which brings us to “crypto bros,” who are often young, male, tech-savvy, and enthusiastic advocates of crypto’s potential to revolutionize the financial world. They tend to push aggressive investment strategies and can be quite willing to take substantial investment risks in search of big profits.

While “crypto bros” have become synonymous with retail crypto traders and investors, the fact is that crypto investors come in all different shapes and sizes.

The Impact of Automation on Crypto Retail Investing

Automation continues to transform the world of crypto trading, making it exponentially faster, more efficient, and more accessible to ever greater numbers of people throughout the world. With the increasing ubiquity of advanced algorithms and cutting-edge technology, automated crypto trading systems can now execute trades in fractions of a second, reacting to market changes in real-time and allowing traders to make the most of opportunities as they happen.

One of the most significant advantages of automated crypto trading for retail investors is the ability to remove human emotion from the decision-making process. Crypto markets remain highly volatile and largely unpredictable, and traders can be prone to making impulsive decisions based on fear, greed, or other emotions (November 2021, anyone?). Automated crypto trading systems, on the other hand, rely on predefined rules and algorithms to make trading decisions, removing the potential for human error and mistakes driven by our emotions.

Automated trading also occurs around the clock. Unlike traditional markets that close on weekends, crypto markets are open for trading 24/7/365, offering a steady stream of opportunities for traders. Automated trading strategies monitor the crypto market around the clock, reacting to price changes and news events as they happen, even while we’re catching up on our beauty sleep.

The simple fact is that automation is revolutionizing the way retail crypto traders approach the crypto market, providing all of us with powerful tools to analyze the market, execute trades, minimize risk, and maximize profits. As the crypto space continues to mature and evolve, automation will play an increasingly important role in shaping its future.

Do Crypto Retail Investors Make Money?

The simple answer is also the obvious answer: yes. Crypto retail investors clearly make money, even during market downturns and the ongoing crypto bear market, by implementing a variety of trading strategies such as margin trading.

Many retail crypto investors have already made significant profits in recent years. The price of bitcoin, for example, increased from roughly $1,000 in 2017 to almost $60,000 in 2021, which led to many early adopters and investors seeing substantial returns on their investments.

An especially profitable way to profit as a crypto retail investor is to engage in social trading, particularly copy trading, by using automated trading bots. The advantage of automated trading is that it removes many of the aforementioned drawbacks of retail trading from the investing equation. And the advantage of automated social trading in which you copy the trades of another trader is that you can benefit from that trader’s experience and expertise without having to do any of the heavy lifting yourself.

The way it works is simple. An expert bot creator will create a crypto trading bot, offer it for rent on a reputable crypto trading bot marketplace such as Trality’s Marketplace, and investors can then invest in the bot for as long as it remains profitable. In this way, both sides have an incentive, which only strengthens the long-term health and stability of the crypto space.

Crypto retail investors interested in a less active approach to trading can also benefit from various passive income opportunities. Long-term crypto investing, otherwise known as HODLing, has many adherents. Additional forms of passive income options available to retail crypto investors include crypto staking, yield farming, crypto lending, dividends, and masternodes, among others.

Whichever trading strategy you use is entirely up to you, but the answer to the question is clear. Crypto retail traders continue to make money through a variety of ways when investing in the crypto market.

Retail vs Institutional Investors—Key Differences

There are a number of important differences between crypto retail and institutional investors. Let’s consider some of them below.

- Size of the investment: Institutional investors typically invest large amounts of money into the crypto market, while retail investors usually invest smaller amounts. Institutional investors have more resources to invest, giving them access to higher-risk, higher-return investment opportunities, while retail investors usually don’t have the same level of capital.

- Approach to investing: Institutional investors often use a more sophisticated investment approach when investing in crypto, such as quantitative analysis and trading algorithms, while retail investors may use simpler strategies or rely on intuition and social media or other retail investment platforms.

- Risk tolerances: Institutional investors typically have a higher risk tolerance than retail investors, as they have the resources to mitigate potential losses and can therefore afford to take on more significant risks. Retail investors, on the other hand, may be more risk-averse and may seek lower-risk investment opportunities.

- Timeline for investing: Institutional investors often have a longer investment horizon than retail investors. They often invest in long-term projects or assets and may hold their investments for several years or more. Retail investors, on the other hand, may have a shorter investment horizon and may prefer to invest in crypto assets with shorter holding periods.

- Regulatory conditions: Institutional investors are subject to more regulatory oversight and scrutiny than retail investors, including things like reporting requirements, transparency, and disclosure. Retail investors, on the other hand, may not face the same level of regulatory oversight, although this is something that is currently being debated in the US and EU.

- Impact on the market: Institutional investors have a more significant impact on the crypto market than retail investors, and their large investments can affect the price of cryptocurrencies. They can also bring more stability and liquidity to the market.

How Can Automation Help Retail Crypto Traders Make More Profitable Trades?

Algorithmic trading revolves around using computer programs to execute trades based on pre-set rules and criteria. Unlike human traders, these high-tech programs can analyze large amounts of data and market indicators to identify potential trading opportunities and execute trades more quickly and efficiently, which is precisely why Wall Street has been using automated trading for decades, but FinTech is starting to chip away at their monopoly on the technology.

Retail crypto traders can now make more profitable trades by using trading bots, which execute trades automatically based on predefined parameters. These bots can be set to monitor market conditions and indicators, and can make trades based on specific criteria such as price movements, trading volume, or other factors, helping traders to make more profitable trades by taking advantage of market conditions in real-time.

Another big advantage to automated trading strategies is that they can be extremely effective at managing risk, particularly if a stop-loss order is implemented. Consequently, retail crypto traders can limit their losses and protect their profits, helping to improve the overall profitability of their trading. The flip side of risk mitigation is backtesting trading strategies and analyzing historical data to identify patterns and trends, which enables traders to refine their trading strategies and make more informed trading decisions.

As with any other type of automation, crypto trading bots excel when it comes to increased efficiency, something it accomplishes by reducing the time and resources required to execute trades manually.

What Are the Best Tools for Crypto Retail Traders?

Call us partial, but we think Trality offers some of the best algo trading strategies for retail investors. Whether you want to code your own trading bot using Python or you’d prefer to let someone else do the heavy lifting for you, Trality has a range of innovative offerings based on the latest developments in artificial intelligence (AI).

Trality’s Python Code Editor

One of Trality’s marquee product offerings, the state-of-the-art Code Builder is the world’s first browser-based Python code bot editor. It is designed for experienced traders who want to develop sophisticated trading algorithms using the latest technology.

Python programmers will feel at home using the Code Editor’s full range of powerful tools and innovative features to create and backtest their algorithms. In-browser editing with intelligent auto-complete as well as in-browser debugging provide a seamless process for the development of trading ideas and their eventual realization as profitable trading bots.

With a full range of technical analysis indicators and a growing number of libraries, including NumPy, the Code Editor provides maximum flexibility for customizing bots based on a variety of market conditions and a variety of short- and long-term trading goals.

Blazing-fast, in-browser backtesting as well as Trality’s proprietary Optimizer also mean that testing and fine-tuning algorithms can be done quickly and easily. Benefit from clear versioning and backtest history, while also having access to financial data with easy-to-use API.

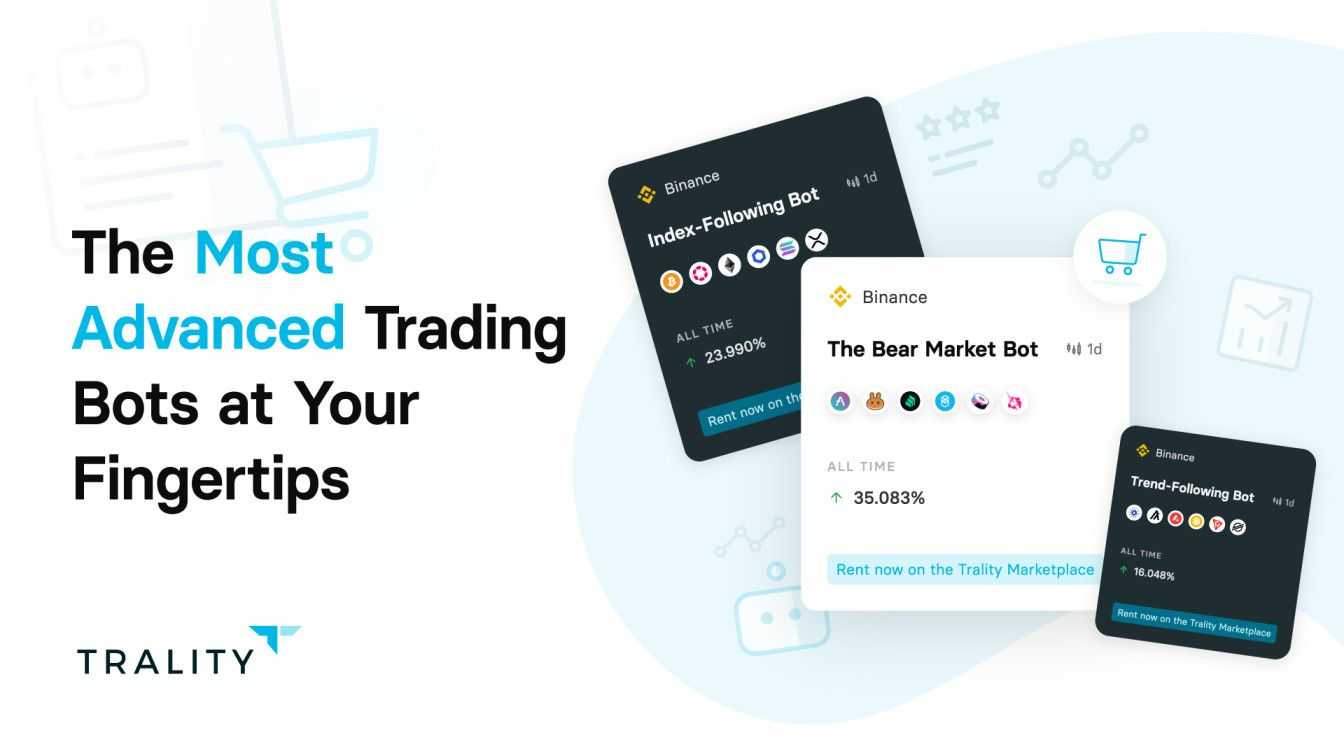

The Trality Bot Marketplace

Trality’s Marketplace is a one-of-a-kind space that brings together crypto trading bot creators and investors for mutually beneficial purposes. Unlike other platforms with anonymous bot makers and unproven bots, Trality’s Marketplace is a carefully curated space with hand-picked creators and the best bots available.

All bots on the Trality Marketplace must pass a rigorous screening process by our Bot Selection Committee, which consists of industry experts with decades of collective experience.

Key metrics used when selecting bots for the Marketplace include risk-adjusted return, minimum trading activity, and time under water. And since the crypto market is a volatile one, all bots are backtested in different market conditions such as bull, bear and sideways market regimes to ensure consistent returns.

Investors can rent profitable bots tailored to specific risk tolerances (low, medium, and high) and individual investment goals. A full suite of metrics is available, allowing investors to decide on a bot based on clear, quantifiable data.

Bot Creators can now monetize their bots and earn passive income from investors around the world by having their bots listed on Trality’s Marketplace. Most importantly, bot algorithms remain completely private, meaning that each creator retains full IP rights.

It’s this uncompromising commitment to a transparent bot evaluation process that distinguishes Trality’s Marketplace from generic, black-box alternatives.

Final Thoughts on Retail Investing and Trading in Crypto

So there you have it—a brief introduction to the world of crypto retail trading and investing and the transformative effects of automation.

While it is difficult to say with any degree of certainty what the future of retail investing and trading in crypto will look like in the coming months and years, it is nevertheless clear that the trend towards digital assets is here to stay.

As more investors and traders become interested in crypto, the market is likely to continue to grow and evolve. In addition to staying abreast of the latest regulatory developments, it is imperative for crypto retail traders to understand advances in blockchain technology, among other things, in order to identify investment opportunities before they hit the mainstream.

Despite the downtrend, the bears, the wintry market conditions, the naysayers, and the SBFs of the crypto ecosystem, it’s still the most exciting, most innovative, and most profitable space to be found anywhere in the world.