Litecoin Price Prediction for 2022-2025

MORITZ PUTZHAMMER

15 November 2022 • 10 min read

Table of contents

Will Litecoin reach $10,000? What will Litecoin be worth in 2025? Is LTC a good investment 2022? Does LTC have a future?

During an extended bear market or even a crypto winter, many traders are looking for reassurance or even clarity regarding future price movements for some of the most popular cryptocurrencies. Long billed as the silver to Bitcoin’s gold, Litecoin’s thunder seems to have been stolen by Ethereum due in part to the latter’s recent Merge, making comparisons between LTC and ETH somewhat more interesting as a result. And LTC has also fallen to a somewhat less-than-impressive position at number seventeen (as of this writing) in terms of its market cap.

However, Litecoin remains a popular cryptocurrency with a number similarities to Bitcoin and even a few advantages, which might be enough to draw the interest of new and established crypto traders, paving the way for its increased use and adoption as the crypto space matures in the coming years.

In the following article, we’ll run through a brief history of Litecoin and consider some of its real-world applications before looking at its short- and long-term price predictions.

What Is Litecoin?

Created on the Bitcoin protocol, Litecoin is billed as a peer-to-peer cryptocurrency for quick, inexpensive international payments. It’s also minable, proof-of-work, open source, and decentralized. The latter makes it a particularly attractive option for those looking to avoid what can be an intrusive KYC process, which virtually all centralized exchanges require. The Litecoin network itself is secured via mathematics and boasts faster transaction confirmation times than many of its rivals.

Having debuted in October 2011, Litecoin remains one of the earliest altcoins. The underlying principle behind it was to offer a more miner-friendly cryptocurrency than Bitcoin, essentially one that the average user can mine without top-of-the-line hardware.

Key Litecoin features:

- Founded by Charlie Lee as a fork of Bitcoin in 2011.

- Has many properties in common with Bitcoin, but some key differences.

- Uses Scrypt-based PoW instead of SHA256-based PoW.

- Privacy-oriented protocol MimbleWimble ensures transaction anonymity.

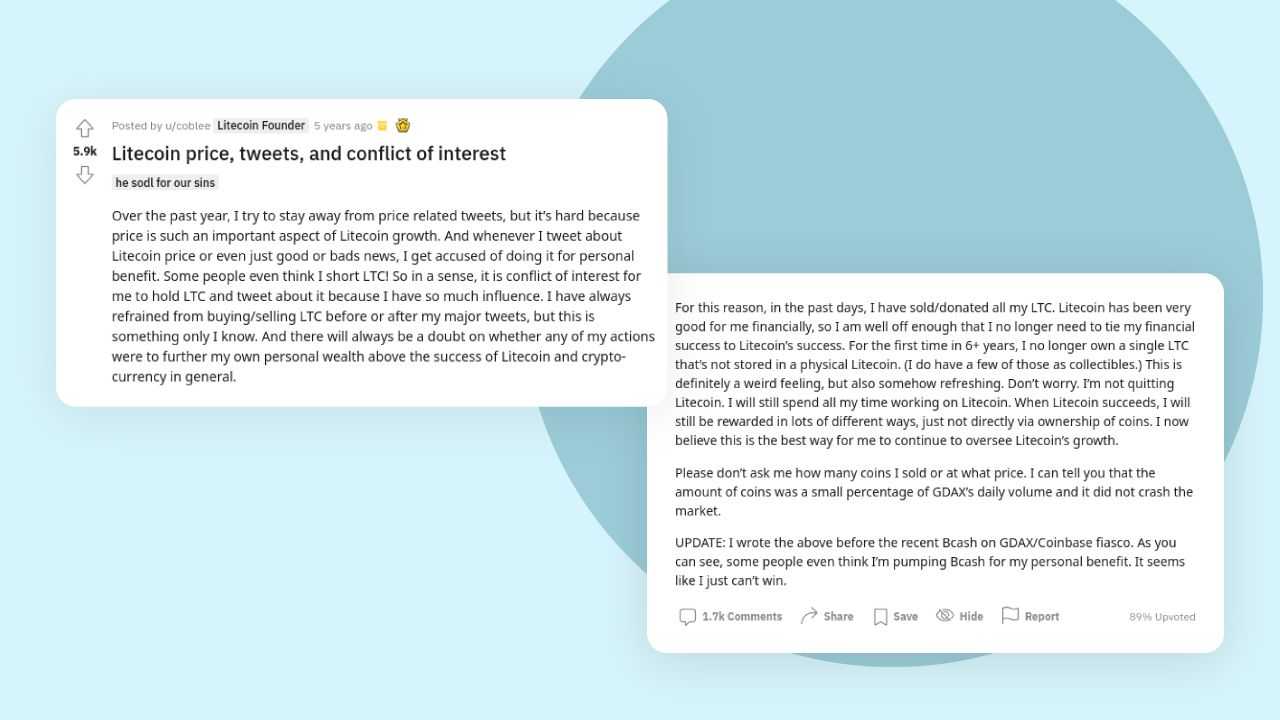

Founder Charlie Lee Divests from Litecoin

The brainchild of Charlie Lee, a former Google engineer and engineering director at Coinbase, Litecoin was meant to address some of the problems with Bitcoin, namely its long transaction times and frequent network congestion issues.

It should be noted that Lee completely divested himself from Litecoin in December 2017, a move that was met with some criticism.

Lee’s rationale was to avoid any semblance of a conflict of interest and, following his departure from Coinbase in June 2017, he has continued to work full time on Litecoin.

Litecoin’s Supply and Halving

Initially released with 150 pre-mined coins, Litecoin’s total supply stands at 84 million coins. The current circulating supply of Litecoin is 71,259,806.28 LTC or roughly 85% of its total number of coins.

Miners create blocks, which are then added to the chain, with each new block being created in just under three minutes (approximately 2.5 minutes to be exact), making Litecoin faster than Bitcoin. When 840,000 blocks are mined, then the mining rewards are halved.

Litecoin halving key dates:

- Aug. 25, 2015: 50 to 25 LTCs

- Aug. 5, 2019: 25 to 12.5 LTCs

- Aug. 23, 2023 (expected): 12.5 to 6.25 LTCs

At the rate of 2.5 blocks a minute, Litecoin halving occurs every four years, and the next Litecoin halving event is expected to occur in August 2023. The intention behind Litecoin halving is to control its supply, which grows at a constant rate.

Litecoin versus Bitcoin

People often frame cryptocurrencies as a zero-sum game, pitting one coin against another in the race to find the best, fastest, most versatile, most profitable, etc. Since Bitcoin is the OG, it’s only natural to compare other coins to it, right?

In the case of Litecoin, it's proof-of-work; it has a finite supply; it’s good for payments; it’s widely accepted; and it’s decentralized. In other words, it sounds a lot like BTC. So why does Bitcoin receive all the hype?

Well, it could simply come down to being the first mover advantage. As the first crypto, BTC has long been synonymous with the word “cryptocurrency” itself.

Things get a bit complicated when considering some of the finer details, though. For example, the layering of payment protocol Lightning on top of Bitcoin should make for faster transactions, possibly solving BTC’s scalability problem and blunting the argument in favor of LTC and its faster speeds.

However, there is also the issue of privacy. Litecoin’s introduction of the so-called “MimbleWimble” is a privacy-preserving technology that addresses Litecoin’s transparency issues (the addresses of senders and recipients as well as the amount(s) being transferred are transparent).

Perhaps instead of differentiating the two in order to assert the superiority of one over the other, we might instead see both as having different values and purposes within the crypto space.

Litecoin’s Price History

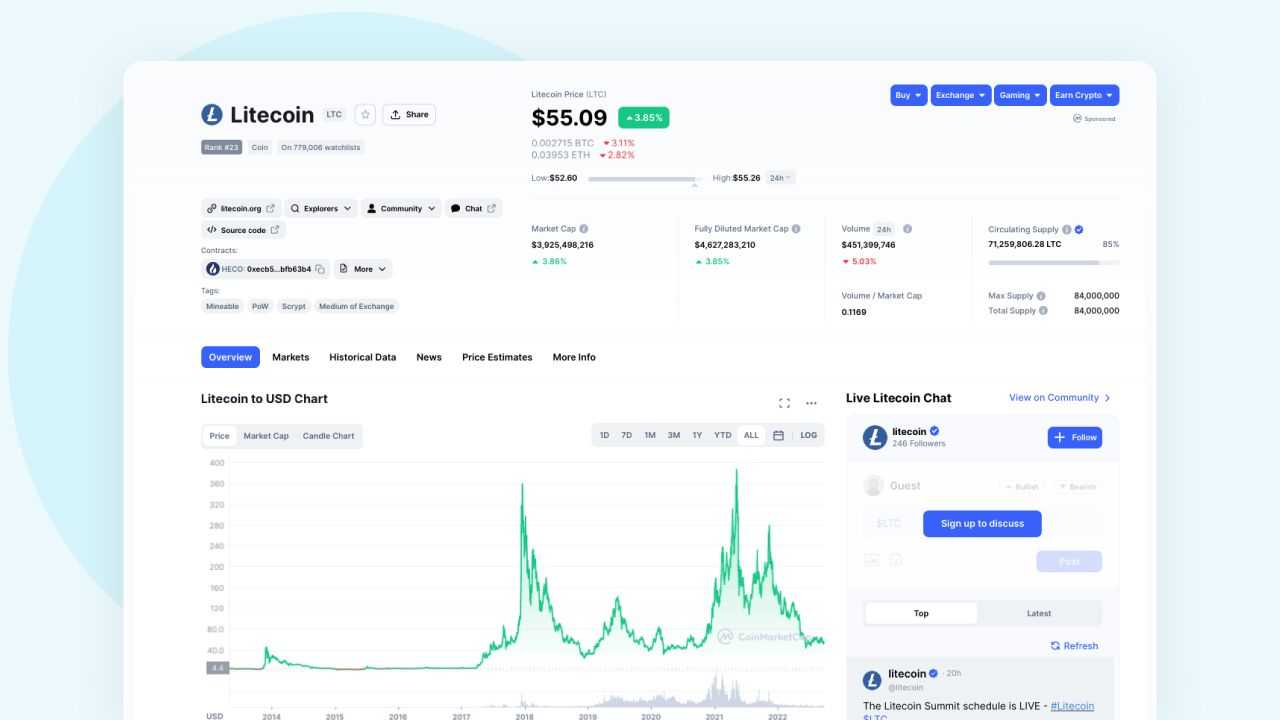

Litecoin remained below $100 for the first half of its lifespan. However, in late 2017, the price hit $70 and then jumped to an all-time high of $410.76 on May 10, 2021. Following the market’s post-November 2021 plunge, though, LTC has remained in the $50 region.

As mentioned, it’s no longer in the top five or even top ten cryptocurrencies based on its market capitalization, having slipped to twenty-second position at the time of writing. However, LTC comes in at fourth place among proof-of-work coins and is currently ranked tenth in terms of Layer-1 coins.

What Factors Affect the Price of Litecoin?

Like all cryptocurrencies, Litecoin is affected by various factors, with upgrades as well as the price of Bitcoin being two of the most important ones. Which crypto isn’t Bitcoin-dependent, for that matter? For example, Litecoin tends to correlate with Bitcoin’s price fairly closely, as most digital assets do. When the price of Bitcoin rises, it usually lifts the price of other coins with it.

Let’s consider supply. Litecoin has a limit of 85 million, which is much higher than Bitcoin and its cap of 21 million, increasing the chances of LTC becoming the more widespread currency of the two. The larger supply could also translate into greater stability, as BTC scarcity might result in increased price volatility.

Similar to Bitcoin, Litecoin also experiences a halving. This literally halves the rewards given to miners for successfully validating a block. Each time this happens, Litecoin becomes a little bit rarer, and the price is projected to increase as a result. It’s impossible to track exactly what price changes are due to the halving instead of other factors, but one can reasonably assume that it plays a role in any price fluctuations.

And there are considerations such as speed, privacy, and scalability, among others. What impact will the Lightning network have on LTC? Is Mimblewimble enough of an argument over Monero in terms of privacy? The jury is still out, with the space constantly evolving as each coin attempts to outperform and outdo its competitors.

Litecoin Price Prediction for 2022-2025

And now for the big reveal—Litecoin price predictions for the near and not-so-near future. Since we’re not clairvoyants, we’ve rounded up various forecasts from a number of reputable sources.

What will Litecoin’s price be in a year? Three years? Even five? If you’re wondering whether or not Litecoin is a good investment, let’s take a look at what the experts have to say.

LongForecast's Litecoin price prediction

LongForecast, a group that uses mathematical and statistical indicators to predict the long-term performance of investments, has gathered some data for Litecoin price prediction over the next few years.

First off, the numbers aren’t promising. Litecoin is expected to close out 2022 at $52.60. In 2023, LTC will continue its steady decline to a final price of $32.80, while 2024 will see it drop to the low $20s before a surge at the end of the year to a hair under $60. 2025 is expected to be a particularly disappointing year, as the price will drop to $24.30 in the final quarter. And 2026 looks to be more of the same, with the price unable to move beyond $46.

Trading Beasts's Litecoin price prediction

Trading Beasts performs daily predictions of different assets based on “historical data and using a combination of linear and polynomial regressions.” As a result, the platform has Litecoin price predictions up until 2025.

These predictions are certainly more optimistic than those of LongForecast. LTC is projected to dip to $52.84 in December 2022, but 2023 will see gains to $75.34. Trading Beasts anticipates continued positive price movements into 2024, with LTC achieving $100.17 before closing out the year at $80.14. Looking ahead to 2025, LTC could flirt with $124.

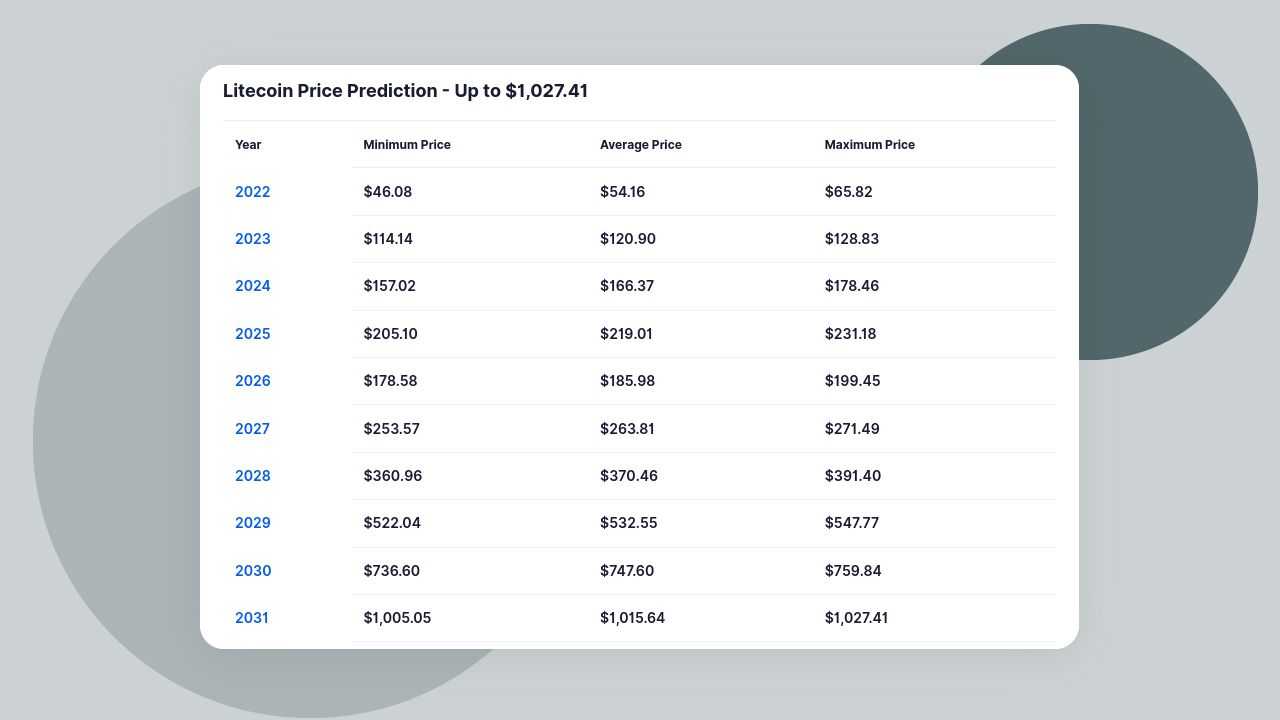

DigitalCoinPrice's Litecoin price prediction

DigitalCoinPrice, a site that makes its predictions based on historical data, is seriously bullish on Litecoin. Let’s look at some numbers.

As we can see, the analysts at Digital Coin Price anticipate steady growth in the average price of Litecoin over the next decade. While we’re a tad skeptical about such long-term price predictions, particularly because crypto is so volatile and the space itself is in its infancy, it’s never a bad idea to compare predictions, however optimistic.

CryptoNewsZ's Litecoin price predictions

In its May 2022 analysis of Litecoin, CryptoNewsZ suggested a certain degree of skepticism about LTC as a short-term investment, but was more optimistic about its long-term prospects.

"The Bollinger bands have squeezed, and the volatility is lesser than before. RSI is moving in the upward direction towards the overbought zone. The current scenario is giving mixed sentiments and thus is not suitable for a short-term investment. However, the current prices are pretty suitable for long-term investment."

2023 is expected to see an increase in LTC’s price to $100, while 2024 could see a drop to $90. In terms of projecting a price for 2025, CryptoNewsZ anticipates a price fluctuation between $115 and $150.

Litecoin Variables: Collaborations, Uptime, NFTs, and Smart Contracts

Most factors that will affect the future of Litecoin are similar to the ones currently shaping its current price. In a way, history might repeat itself. More halvings, for example, are bound to occur, meaning that the asset becomes rarer, potentially increasing its value.

Another thing to consider when thinking about Litecoin price predictions is collaborations. In fact, Litecoin has been branded as the most collaborative cryptocurrency given its many partnerships. Litecoin, for example, has already partnered with Atari as the game console’s official cryptocurrency. Additional Litecoin collaborations include Litecoin has many collaborations with several companies among which are UFC, Travala, eGifter, BlockFi, Glory Kickboxing, WEG Bank AG, NordVPN, Nimblewimnle, Re/Max London, The Miami Dolphins, and MeconCash.

As Litecoin seeks greater adoption, it might be worth keeping an eye on the number and type collaborations and partnerships that it cements.

Crucially, Litecoin also has 100% uptime, the longest of any coin in crypto. Liteverse, the first NFT marketplace for Litecoin, is up and running. And OmniLite allows for the creation and management of tokens on the Litecoin network.

And while we’re at it, we might as well mention that a Chinese court just ruled that Litecoin is protected by property law in China, despite the country’s ban on crypto. Could this signal a chance of course for Beijing? If so, then it will have started with Litecoin.

Is Litecoin a Good Investment in 2022 and Beyond?

Trading Litecoin can be a rollercoaster of ups and downs. But, then again, show me a crypto that isn’t a rollercoaster of emotions. And while it’s obviously impossible to predict Litecoin’s price with any degree of absolute certainty, there is positive sentiment surrounding the asset, especially when it comes to its long-term prospects.

At this point, most experts tend to fall on the bearish side of the coin when it comes to LTC’s price in the coming three-to-five years, but we’re also in the midst of a crypto winter. And bearing in mind that the crypto market moves in cycles, LTC could see significant corresponding price increases during the next crypto bull run.

Keep in mind, too, that we are still in the early days of crypto, with adoption and regulation still being debated. We’re bound to see massive price hikes over the next decade or so as the technology breaks into the mainstream.

Final Thoughts

While no one can guarantee profits, investing in Litecoin now could result in significant gains in the future. (If you’re interested in learning more about Litecoin and its future, then check out October's Litecoin Summit 2022.)

And if you’re interested in reading more about the general subject, then check out our articles on the best cryptocurrencies to invest in or some of the most undervalued cryptocurrencies, which might have flown under your radar.

Believe it or not, it’s even still possible to make money during a bear market!

Of course, it’s important to do your own research before putting money into any cryptocurrency, particularly since the space is volatile and therefore bound to continue to exhibit a certain degree of unpredictability. Perhaps more importantly, never risk more money than you can afford to lose.