Most Undervalued Crypto 2023

MORITZ PUTZHAMMER

17 April 2023 • 13 min read

Table of contents

If there is one thing everyone knows about the crypto market, it’s that it is incredibly volatile. Inspiring stories of people making millions during a market upswing make headlines about as often as the dark tragedies of people losing everything during downswings. And with so many cryptocurrencies from which to choose, picking the most undervalued ones only complicates matters.

It is understandably tough to assign value to a cryptocurrency because there is no physical product or centralized organizing body to which investors can look for positive indicators. However, there are many concrete ways that crypto acquires value, and these include things like technological developments, supply and demand, celebrity endorsements, whales, and competition, among other things.

In this article, we’re going to focus on the most undervalued cryptocurrencies in 2023 and how to spot them.

What’s the Difference between Value and Price?

Value and price are two distinct concepts, and it’s crucial for investors to understand them when assessing investment opportunities.

Price is simply the amount of money that is required to purchase a given asset or investment. It is determined by supply and demand and can fluctuate rapidly based on a variety of factors such as market trends, news events, and economic indicators.

Conversely, value refers to the intrinsic worth of an investment. It is determined by assessing the underlying assets, earnings potential, and other fundamental factors that can affect the future growth prospects of the investment.

Investors who focus primarily on price may be more concerned with short-term gains and losses, whereas investors who focus on value may be more interested in the long-term potential of an investment.

For example, a crypto may have a high stock price due to market hype and speculation, but its underlying fundamentals may not support such a high valuation. On the other hand, another crypto might suffer in terms of its price due to temporary setbacks or negative news (among other things), but its underlying value may still be strong.

Understanding the difference between value and price can help you make more informed decisions and avoid overpaying for cryptos that may not provide long-term growth potential (if indeed you’re interested in long-term investing)

How Do Cryptocurrencies Acquire Value?

Cryptocurrencies acquire value through a combination of factors, including supply and demand, market speculation, utility, and network effects.

Supply and demand play a significant role in determining the value of a cryptocurrency. If the demand for a particular cryptocurrency exceeds the supply, then the price of that cryptocurrency is likely to increase. Conversely, if the supply of a cryptocurrency exceeds the demand, then the price is likely to decrease.

Market speculation can also drive the value of a cryptocurrency, which in turn affects its volume. If investors believe that a particular cryptocurrency will increase in value in the future, they may buy it in large quantities, driving up the price (whales, we’re looking at you). This, in turn, can create a self-fulfilling prophecy as more investors jump on board, further driving up the price.

The utility of a cryptocurrency can also impact its value. If a cryptocurrency has practical use cases, such as being used as a means of payment or as a store of value, then it is likely to be more valuable than a cryptocurrency with limited utility.

Network effects also play a role in the value of a cryptocurrency. As more people use a particular cryptocurrency, it becomes more valuable due to its increased liquidity and network effects, creating a positive feedback loop in which the value of the cryptocurrency increases as more people adopt it.

Overall, the value of a cryptocurrency is determined by a complex interplay of the aforementioned factors (as well as others).

What Are the Most Undervalued Cryptos in 2023?

As we all know, the cryptocurrency market took a big hit in early 2022 as inflation, global market uncertainty over crypto risks, and the Russian invasion of Ukraine pushed crypto price thresholds to new lows. What does this mean for you as an investor?

Well, there’s no better time to invest, as the next crypto bull run might be right around the corner. FOMO, anyone?

Below are six of the most undervalued cryptocurrencies in 2023.

Arbitrum (ARB)

Arbitrum (ARB) is a Layer 2 scaling solution for Ethereum that aims to improve the speed and efficiency of transactions on the Ethereum blockchain. It was launched in 2021 by Offchain Labs, a company focused on building scalable blockchain solutions.

Arbitrum uses a technology called Optimistic Rollups, which allows for faster and cheaper transactions on the Ethereum network by batching multiple transactions into a single transaction and verifying them off-chain. This reduces the burden on the Ethereum blockchain, allowing it to process more transactions at a faster speed and lower cost.

One of the main benefits of Arbitrum is its interoperability with the Ethereum blockchain. It is designed to be fully compatible with Ethereum, meaning that users can easily move their assets and data between the two networks. This makes it easy for developers to build decentralized applications (dApps) that work across both networks.

Arbitrum also offers a range of other features, including a user-friendly developer toolkit, support for smart contracts, and a high level of security. It uses a combination of cryptographic proofs and game theory to ensure the integrity of transactions and prevent attacks on the network.

Cosmos (ATOM)

Cosmos (ATOM) is a decentralized blockchain platform that was launched in 2019. It aims to create an ecosystem of interconnected blockchains, allowing for seamless communication and exchange of assets between different blockchain networks.

Cosmos uses a unique consensus algorithm called Ignite (formerly Tendermint), which is a Byzantine fault-tolerant (BFT) Proof-of-Stake (PoS) consensus mechanism. This algorithm allows for fast and secure transactions and ensures that the network remains decentralized and resistant to attacks.

One of the main features of Cosmos is its interoperability, which allows different blockchain networks to communicate with each other using the Inter-Blockchain Communication (IBC) protocol. As a result, assets and data can be transferred between different blockchains, regardless of their underlying technology.

Cosmos also allows for the creation of new custom blockchains, known as zones, which can be tailored to specific use cases and needs. These zones can be interconnected with other zones in the Cosmos ecosystem, allowing for a seamless exchange of assets and data.

In addition, Cosmos uses a staking mechanism where users can stake their ATOM tokens to help secure the network and earn rewards in return. Staking also allows for governance of the network, with stakers having the ability to vote on proposals for network upgrades and changes.

Overall, Cosmos is an innovative blockchain platform that aims to create an interconnected ecosystem of blockchains, allowing for seamless communication and exchange of assets between different networks. Its use of the Ignite consensus algorithm and the IBC protocol make it a fast and secure option for users and developers, while the ability to create custom zones and staking offer additional flexibility and governance.

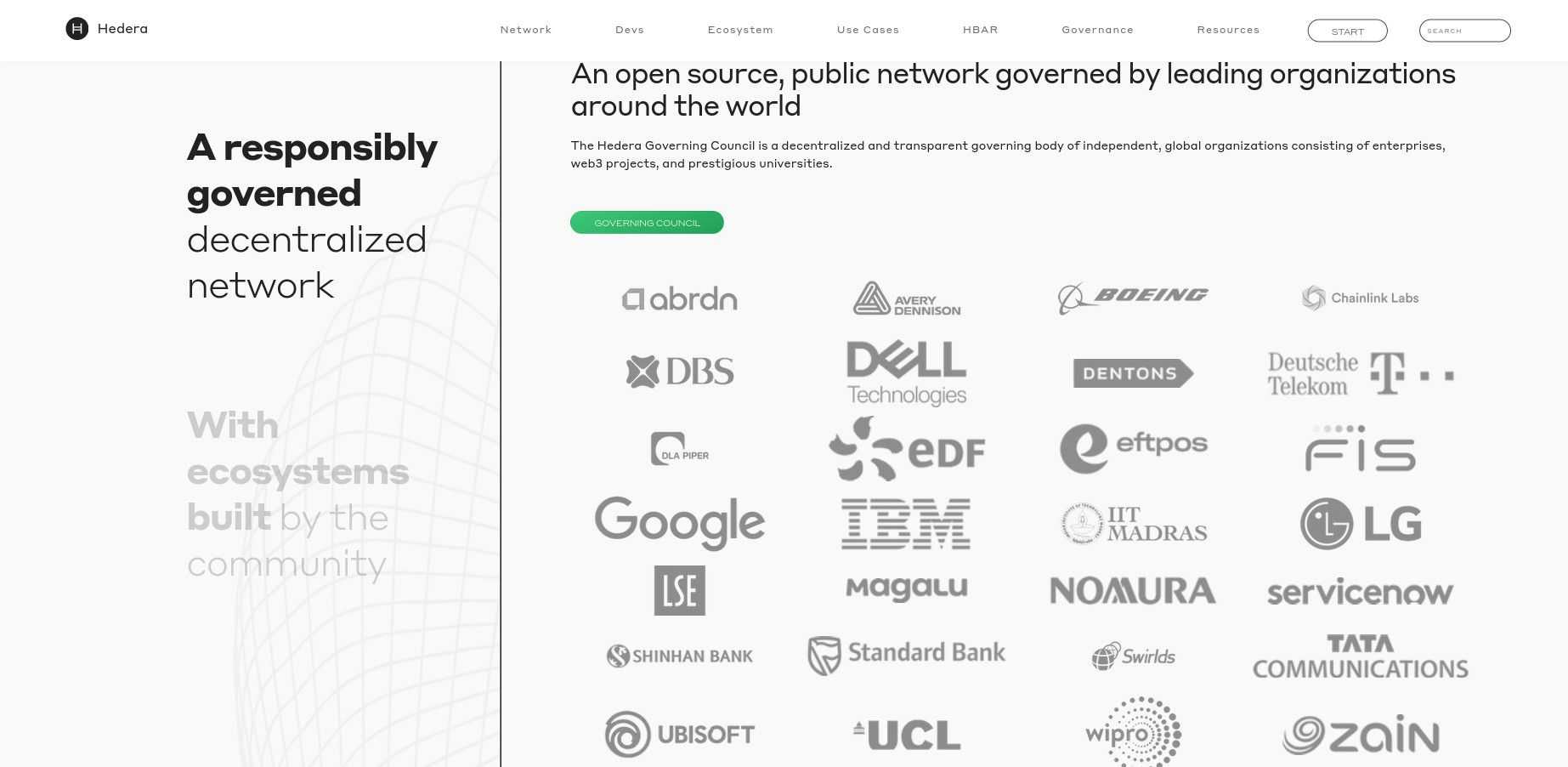

Hedera (HBAR)

Hedera Hashgraph (also known as Hedera) is a public distributed ledger or blockchain technology that was launched in 2018. Hedera uses a unique consensus algorithm called Hashgraph, which is a patented technology that claims to be faster, fairer, and more secure than traditional blockchain technologies.

Hedera is designed to be a decentralized platform for building decentralized applications (dApps) that can be used across multiple industries, such as finance, gaming, social media, and supply chain management. It allows developers to create smart contracts and build decentralized applications on top of its platform.

One of the main benefits of Hedera is its speed and scalability. The Hashgraph consensus algorithm is designed to process thousands of transactions per second, which is significantly faster than other blockchain technologies like Bitcoin and Ethereum. Additionally, Hedera is designed to be highly secure and resistant to attacks.

Hedera uses its native cryptocurrency called HBAR as the fuel for transactions on its network. HBAR can be used to pay for transaction fees, storage, and computation on the Hedera network, among a growing list of things.

Hedera is also unique in that it is governed by a council of large, trusted companies from various industries, such as IBM, Google, Boeing, and Tata Communications. Its council is responsible for maintaining the network, making decisions about its future development, and ensuring its security and stability.

Cronos (CRO)

Cronos (CRO) is a cryptocurrency that was launched in 2021 as part of the Crypto.com ecosystem. Crypto.com is a cryptocurrency exchange and payment platform that allows users to buy, sell, and spend cryptocurrencies.

Cronos is built on the Ethereum blockchain and is designed to offer fast and secure transactions for users. It uses the Proof-of-Stake consensus algorithm, which allows users to stake their CRO tokens to help secure the network and earn rewards in return.

One of the main features of Cronos is its interoperability, which allows it to connect with other blockchain networks through the Crypto.org Chain, making it easy to exchange assets and data between different blockchains such as Ethereum and Cosmos.

Cronos also offers a range of other features, including CRODEX, its decentralized exchange (DEX), a non-fungible token (NFT) marketplace, and a lending platform. These features allow users to trade, invest, and earn interest on their cryptocurrencies, all within the Crypto.com ecosystem.

In addition, Cronos is designed to be user-friendly via Crypto.com’s intuitive mobile app, which makes it easy for users to manage their cryptocurrencies and make transactions. It also offers a range of rewards and benefits for users who hold and stake their CRO tokens.

Overall, Cronos is an undervalued coin that offers fast and secure transactions, interoperability with other blockchain networks, and a range of features and benefits for users within the Crypto.com ecosystem.

Lisk (LSK)

Lisk (LSK) is a blockchain platform and cryptocurrency that was launched in 2016. It is designed to make it easy for developers to create decentralized applications (dApps) using the Lisk SDK and deploy them on their own sidechain.

As the team describe on their website:

Lisk is an open-source web3 application platform that is designed for interoperability with sidechains. Its Javascript SDK gives developers a straightforward path into launching their own Lisk compatible blockchains.

One of the main features of Lisk is its use of sidechains, which are individual blockchains that can be customized for specific use cases and needs. Each sidechain can have its own consensus algorithm, token economy, and governance structure, allowing for greater flexibility and customization than a single, monolithic blockchain.

Lisk also uses a delegated proof-of-stake (DPoS) consensus algorithm, which allows users to vote for delegates who are responsible for maintaining the network and processing transactions. This helps to ensure that the network remains decentralized and secure, while also allowing for fast and efficient transaction processing.

In addition to its blockchain platform, Lisk also has its own cryptocurrency (LSK) which is used to pay for transactions and access dApps on the Lisk network. LSK can be staked by users to participate in the network and earn rewards.

All in all, Lisk is a blockchain platform with Web3 in its sights, one that offers a range of features and benefits for developers looking to create decentralized applications. Its use of sidechains, DPoS consensus algorithm, and community-focused approach make it a promising option for those interested in blockchain development and innovation.

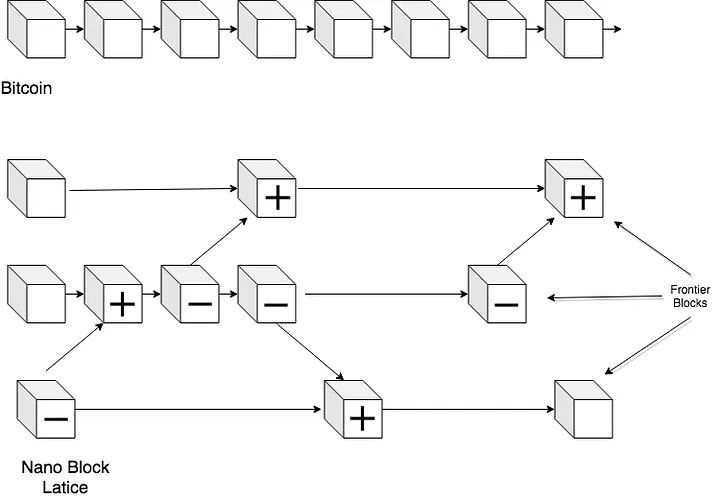

Nano (XNO)

Nano (XNO) is a cryptocurrency that was created in 2015 and is designed to offer fast, feeless transactions. Unlike other cryptocurrencies, Nano uses a unique consensus algorithm called Block Lattice, which allows for instant confirmation of transactions without the need for miners or transaction fees.

Nano's Block Lattice technology is based on a series of individual blockchain structures, each representing a user's account. Each account has its own blockchain, which contains only the transaction history of that account. This design allows for fast and efficient processing of transactions, as each account can confirm its own transactions without the need for network-wide consensus.

Nano transactions are also feeless, meaning that there are no transaction fees associated with sending or receiving Nano. This is in contrast to other cryptocurrencies like Bitcoin and Ethereum, which often require users to pay high fees during times of network congestion.

In addition to its fast and feeless transaction capabilities, Nano also boasts a high degree of security. The Block Lattice design allows for quick confirmation of transactions, which reduces the risk of double-spending attacks. Additionally, Nano uses a delegated proof-of-stake consensus mechanism to prevent Sybil attacks and ensure the security of the network.

Nano is a unique (and indeed undervalued) crypto that offers fast, feeless transactions and a high degree of security. Its innovative Block Lattice technology and delegated proof-of-stake consensus mechanism make it an attractive option for users looking for a fast and efficient way to send and receive cryptocurrency.

How to Identify the Most Undervalued Crypto

The value of any currency is primarily determined by its supply and demand. For example, the value of the U.S. dollar can be determined by looking at the number of dollars held in foreign exchange reserves—the more dollars foreign governments hold, the scarcer the supply, and the greater its value.

The mechanisms that determine the value of cryptocurrencies (whether they’re undervalued, overvalued, or just about right) are actually similar. Just like the U.S. dollar, a cryptocurrency’s value is determined primarily by supply and demand and a few other factors, which we will take a look at below.

Crypto supply and demand

The supply of a cryptocurrency and the demand for that supply is fundamental to determining an asset’s price. A scarce digital asset is likely to have much greater value than something that is widely available.

We can illustrate this by looking at the values of Bitcoin and Dogecoin. Bitcoin’s supply is capped at 21 million coins. New coins are minted at a fixed rate that is halved every four years. The halving event has become a highly anticipated event because every time Bitcoin has halved, the number of newly minted coins has corresponded with a significant price increase as it indicates a reduction in supply. For example, the first halving in 2012 saw an increase in the price of Bitcoin from $12 to approximately $964 one year later.

On the other hand, Dogecoin has an unlimited supply because it is a meme currency that was never meant to function as a serious investment. New coins are minted at a rate of 10,000 per minute, which is why there are over 138 billion DOGE in circulation in 2023.

Crypto competition

The early days of cryptocurrency had very few competitors in the space, and that helped Bitcoin carve out a niche for itself that makes up more than half the crypto market by market capitalization. However, times are changing, and now there are just under 23,000 cryptocurrencies on the market all vying for attention.

New coins are launched every day as the barrier to entry is relatively low. However, creating a viable and successful project also requires building a network of users for that project. A project with a useful application can quickly build a network, especially if it improves upon a limitation of existing competition. If a new competitor gains steam, it takes value from its competition, sending the price of the incumbent down as its price moves up.

Crypto tech developments

New tech developments can have a big impact on the value of cryptocurrencies. Many gain value as a result of improvements to existing infrastructure. For example, hard and soft forks often create buzz around a coin, altering the market’s perception of value.

However, it’s important to point out that tech developments can sometimes have the opposite effect. For example, in August 2021 the value of Cardano (ADA) surged approximately 22% in anticipation of a hard fork that would lead to a smart contract update. The hard fork received a lukewarm reception and ended up having very little impact on the value of ADA. In the aftermath of the hard fork, the value of ADA dropped 10%.

Crypto celebrity endorsements

Celebrity endorsements can have a huge impact on the value of a cryptocurrency. In fact, countless A-list celebrities have gone crypto. Billionaires like Elon Musk and Mark Cuban and celebrities like Snoop Dogg, Reese Witherspoon, Bill Gates, Paris Hilton, and Kanye West (just to name a few) are all crypto investors.

The rise of Dogecoin in 2021 is a great example of celebrity endorsement in action. The coin itself was created purely as a meme that wasn’t meant to be taken seriously, but its value jumped significantly following a series of tweets by Elon Musk. In December 2020, Musk tweeted out, “One Word: Doge,” and that caused the value of Dogecoin to rise by 20%. BOOM.

A few months later in February 2021, DOGE’s value rose by almost 40% after Musk called it “the people’s crypto” on Twitter. Musk continued to promote Dogecoin, which significantly boosted the coin’s value in 2021. In January 2022, the billionaire announced that DOGE could be used to buy Tesla merchandise, which caused its value to increase by 15%. By that point, the meme coin’s value had soared over 5,859% over the past 12 months, according to data from Coinbase.

Of course, the hype for DOGE can’t really last forever due to how it is designed. Dogecoin has an uncapped market supply and there is no limit to the amount of DOGE that can be created via mining, which means the coin is highly inflationary. Millions of new Dogecoins are minted every day, making it impossible for speculative price gains to stick over time.

Crypto whales

Celebrities aren’t the only people with the power to shake up the crypto market. The majority of crypto whales—investors who hold a large amount of a particular cryptocurrency—are actually not celebrities.

Massive purchases by crypto whales can have a significant impact on the price of a cryptocurrency. A whale can artificially inflate the value of a cryptocurrency by placing huge orders, forcing bidders to raise their bid price. The sudden price increase creates fear of missing out among smaller investors and helps stimulate interest in a cryptocurrency.

Final Thoughts on the Most Undervalued Crypto

No one can say with absolute certainty what direction the market will trend in 2023 and beyond, but investing in crypto is always a worthwhile venture.

The six cryptocurrencies discussed in this guide are clearly undervalued at their current bargain prices. They have the potential to gain momentum thanks to their underlying technology and noteworthy endorsements, which may translate to great profits beyond 2023.

Smart crypto investing is largely a waiting game. The bearish conditions that the crypto market continues to experience is nothing compared to the bloodbath investors weathered in 2018. It may even be a boon for newbies looking for new investment options and veterans who want to add to their existing portfolio.

Whichever undervalued coin(s) you choose, always do your own research and never risk more than you can afford to lose!