A Guide to Earning Passive Income in DeFi

MORITZ PUTZHAMMER

20 March 2023 • 9 min read

Table of contents

With the ongoing crypto winter, crypto traders would appear to have few options when it comes to investing. For those committed to crypto’s long-term prospects, HODLing is likely the most attractive option at this point, as the crypto market gradually smoothes the rough edges of its peaks and troughs. The more adventurous among us might be drawn to a somewhat riskier (and therefore profitable) strategy such as margin trading, the goal of which is to boost returns by multiplying positions through leverage.

While the aforementioned approaches consist of a passive and active strategy, still others might opt for a combination of the two, neither entirely passive as in the case of HODing nor explicitly active as with margin trading, which is where the lure of passive income becomes particularly strong.

For readers familiar with our blog, you’ll have already read our article on how to earn passive income in crypto, which covers a few options for making your coins work for you in the world of DeFi. Since we only scratched the surface, though, we’ve decided to take a deeper look at the sometimes weird and wonderful world of passive income in decentralized finance.

Let’s get to it!

What Is Decentralized Finance (DeFi)?

There are many ways to define decentralized finance, but let’s begin with a definition by negation. We all know what DeFi is not, namely centralized finance (CeFi).

In fact, DeFi’s very emergence and continued persistence, its raison d'être is to offer an alternative to the many ills and shortcomings that continue to plague traditional centralized finance. From millions of unbanked and underbanked, high fees and low interest to lengthy settlement times and fees as well as a greater susceptibility to cyberattacks, centralized finance (how shall we put it?) has problems. And DeFi adherents argue that they have the solutions.

So is DeFi nothing more than one of the latest crypto buzzwords? Not exactly. In terms of a basic definition, decentralized finance essentially describes an approach to finance that sees decentralized, blockchain-based technologies as the starting point. By allowing for the creation and management of financial applications and services that are open, permissionless, and accessible to anyone, individuals no longer have to rely on the flawed legacy, centralized financial system and its traditional financial intermediaries such as banks or governments.

As mentioned, DeFi applications effectively operate on decentralized blockchains, with Ethereum being one of the most popular examples, and use what are referred to as “smart contracts” in order to automate a number of manual operations, including financial transactions, lending, borrowing, and trading. In contrast to CeFi, DeFi has been designed to be transparent, trustless, and resistant to censorship. Theoretically, it provides anyone with access to financial services without the problematic (and often rapacious) financial intermediaries (with their high fees, intrusive policies, and gatekeeping duties).

It should come as no surprise, then, that there are various ways to earn passive income in DeFi, dealing as it does with financial transactions, trading, and investing via decentralized exchanges, lending platforms, and various cryptocurrencies (and the underlying blockchains upon which the projects are built and operate).

Earning Passive Income in DeFi

Now let’s say that you’re committed to DeFi on principle alone, but want to know how to make money through various DeFi protocols. Where and even how can you get started? Let’s take a look at a couple of familiar options, which have benefited from a few updates in recent months.

DeFi Lending and Borrowing

If you’re interested in DeFi lending and borrowing, then you might consider one or a number of various platforms, which include Compound, Aave, Maker, and Instadapp, among others. The goal is to lend your crypto to earn interest, or borrow crypto by providing collateral (as always, keep an eye on interest rates, which vary).

In terms of DeFi lending, the process can be quite straightforward, particularly since lending through a decentralized application or DApp is an efficient process. You would typically deposit your crypto into a lending protocol such as Compound or Aave, with your coins being added to a liquidity pool and made available for other users to borrow as a result. As an incentive for loaning your crypto, you earn interest, which can be paid in the form of the loaned crypto or a stablecoin.

This process is often referred to as “yield farming,” and, as we explained in a previous article “Yield Farming vs Staking vs Liquidity Mining,” DeFi lending can be a viable, even profitable way to earn passive income, but there are a few things to bear in mind.

The obvious downside is that your lent coins could be locked into the liquidity pool for a predetermined period of time. Not only do you lose control over your coins for a period of time, but they are also at risk of something called “impermanent loss.” Contrary to what you might think, it is in fact possible to incur a loss when providing liquidity to a liquidity pool, as the price of your coins can change relative to when they were deposited.

In terms of DeFi borrowing, it can be accomplished with a specific interest rate through peer-to-peer lending, thereby removing the need for intermediaries such as traditional banking institutions. As you would imagine, the process itself is much more efficient as a result, since borrowers use automated DApps or smart contracts, which eliminate lengthy waiting times for the transfer of funds. Borrowers no longer have to deal with intrusive credit checks by a bevy of institutions either. And if you’re concerned about crypto’s notorious volatility (and you should be), some DeFi lending protocols offer rate-switching, which allows borrowers to alternate between fixed and variable interest rates as a hedge against said volatility.

As with DeFi lending, DeFi borrowing is not without risks. Consider the matter of “flash loans,” which involves an uncollateralized loan. The borrower is given assets without any initial collateral under the condition that the loan is paid back in the very same blockchain transaction (thus the “flash” in flash loan). As Chainlink explains:

Flash loans enable users to borrow assets from an on-chain liquidity pool with no upfront collateral as long as the borrowed amount of liquidity, plus a small fee, is returned to the pool within the same transaction. If the borrower does not pay back the loan in the same transaction, then the entire transaction is reverted, including the initial borrow and any actions taken afterward.

The downside in this case is that borrowers might take out large amounts of crypto, which could then be used to manipulate the price of the tokens.

DeFi Plain Staking vs DeFi Liquid Staking

Yield farming and staking are quite similar, but there are nevertheless a few differences. Chief among them is that investors interested in staking decide upon a staking pool and lock their crypto into the pool for a specific period of time, a process known as “plain staking.” It can also be painstaking to watch your staked crypto devalue without any ability to remove your coins, which is one reason why an alternative is now being offered. In other words, while you can earn governance rights and passive income through traditional staking, the downside is capital inefficient.

As CoinTelegraph has reported recently, DeFi’s next big thing is something referred to as “liquidity staking derivatives” or “LSDs” for short. They’re basically a new type of token, the purpose of which is to address some of the downsides of plain staking, such as illiquid funds and a lack of flexibility during the staking period.

We know that plain staking is a process in which crypto investors can participate in the network validation and governance of proof-of-stake (PoS) blockchain networks. By staking their tokens, they earn rewards in the form of additional tokens. However, staking typically requires locking up the staked tokens for a period of time, which can limit their liquidity and ability to be traded on the market. Liquid staking derivatives solve this problem by allowing users to trade a derivative token that represents their staked tokens, while still earning rewards as if their tokens were staked.

Here’s how Bybit describes liquid staking:

Liquid staking provides a staker liquidity on their staked tokens via tokenization. Liquid staking derivatives are tokens that have an equivalent value to the amount that the user has staked.

Through the use of the liquid staking derivatives tokens, the assets of an equivalent value may be used on other DeFi protocols and still earn staking rewards. With liquid staking, token holders may be more motivated to stake their native tokens and contribute to the stability and security of the network.

The main benefit to liquid staking is that investors never lose access to the staked coins because said tokens aren’t locked away for a specific period of time. You also get staking derivatives, or a form of collateral against your staked coins, providing the best of both worlds, which is to say passive income and flexibility as well as a certain measure of reassurance. For these reasons and others, liquid staking derivatives are proving to be extremely popular, becoming the second-largest sector in DeFi.

Ethereum and DeFi Liquidity Staking Derivatives

Passive income is all well and good, but staking has scared away many an investor. Rendering your tokens inaccessible isn’t exactly an ideal scenario, but the flexibility of liquid staking has the knock-on benefit of increasing the number of people who will commit their tokens. Having removed the main pain point of staking, now increasing numbers of investors are embracing liquid staking, making the DeFi more active, more robust, and more resilient as a result.

Ethereum investors in particular have been drawn to liquid staking, primarily because of the inherent limitations of staking ETH. Whereas plain staking Ethereum requires a minimum of 32 ETH (and the staked ETH cannot be “unstaked”, at least not until the forthcoming Shanghai upgrade), liquid staking derivatives unlock the liquidity of your staked ETH. Moreover, the liquid staking protocol Rocket Pool allows those with ETH to stake fractional amounts (as little as 0.01 ETH). In return, investors receive ERC-20-compliant liquid staking derivatives, thereby providing a lower barrier of entry for investors with fewer than 32 ETH.

The popular self-custodial crypto wallet MetaMask greeted 2023 with the introduction of a new feature. Dubbed “MetaMask Staking,” the feature within their Portfolio Dapp allows users to stake ETH via MetaMask with Lido and Rocket Pool. MetaMask, among others, are responding to the post-Merge world in which ETH holders are looking for a simpler way to stake their coins while still earning passive income and helping to secure the Ethereum blockchain.

Some of the best liquid staking protocols include Lido DAO, Frax Finance, Rocket Pool, and Ankr.

DeFi Index-Based Bots

Let’s say that you’re interested in DeFi and its potential to help you make money, but aren’t quite ready to jump into the deep end of the DeFi pool. Are there any viable ways to get your toes wet and still earn some passive income?

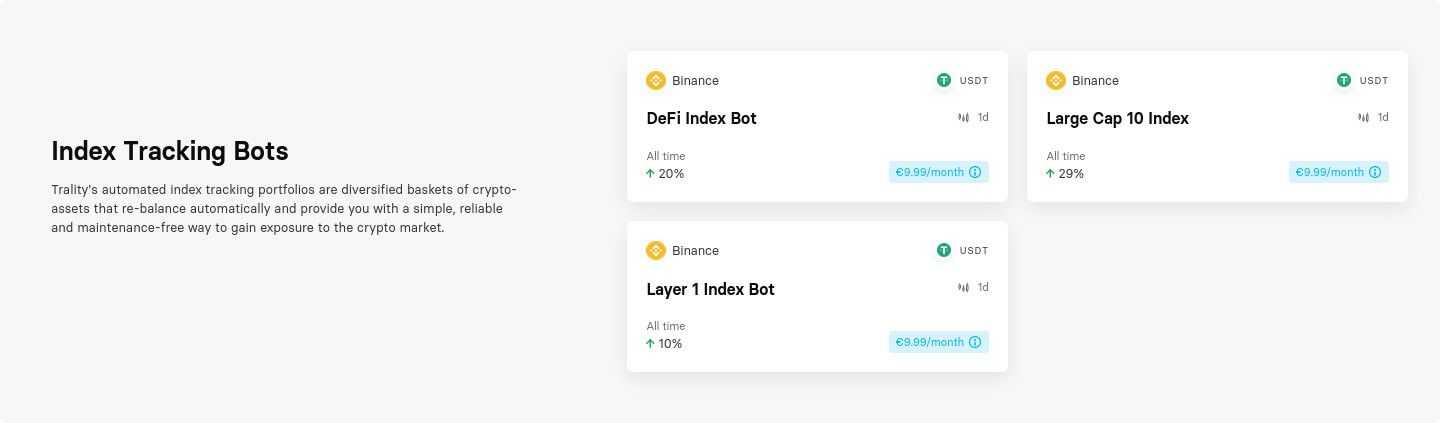

One option is to rent index-based crypto trading bots linked to DeFi. On the Trality Marketplace, for example, you’ll find a “DeFi Smart Beta Index” bot that tracks the performance of 10 popular DeFi crypto-assets. The bot rebalances automatically and provides passive investors with a simple, reliable and maintenance-free way to gain exposure to DeFi.

The bot invests in AAVE, AVAX, CAKE, COMP, CRV, ETH, FTM, GRT, SUSHI and UNI—each at a 10% allocation. The strategy uses a momentum signal that prevents the bot from buying assets when they are dropping and selling assets prematurely when they are rising. This smart beta approach improves the performance of the bot over a simple weighted index.

If you believe in the future of DeFi, then this DeFi Index-based Bot is for you!

Some Final Thoughts on Earning Passive Income in DeFi

Overall, DeFi lending and borrowing provide a decentralized alternative to traditional lending and borrowing, providing an alternative for crypto investors to access credit and earn interest on their crypto holdings without the need for intermediaries.

Nevertheless, it's important to remember that there are indeed certain risks associated with DeFi lending and borrowing as well as with other passive income-earning practices within the decentralized finance space, including smart contract vulnerabilities, the ever-present crypto market volatility, and the possibility of liquidation in the event of default.

If anything, though, the crypto space continues to demonstrate its resiliency and innovative nature, which are on full display with practices such as liquid staking derivatives. But all of this begs the question: if more and more people come together for the purposes of DeFi yield farming and staking, to what extent will the space remain truly decentralized?

Check back again with us post-Shanghai upgrade for an update!