Why Crypto Arbitrage is NOT a Profitable Strategy

MORITZ PUTZHAMMER

05 July 2022 • 11 min read

Table of contents

There are many different ways to trade crypto. Some investors prefer a buy and HODL approach, especially during bear markets or crypto winters. At the opposite end of the spectrum are day traders, who carry out a number of intraday trades in order to take profit in a much shorter time frame.

For crypto day traders, arbitrage may seem like an attractive option, but looks can be deceiving. In the following article, we’ll examine arbitrage, particularly crypto arbitrage, and examine if profitable crypto arbitrage opportunities actually exist or whether traders should be wary of crypto arbitrage trading.

What is Arbitrage?

Many traders are excited about the prospect of making a few bucks from the discrepancies between exchanges but before you run off to quit your job and starting cashing in, you should absolutely read this article and understand why you should think carefully about whether it is for you.

Different Types of Arbitrage

Triangular arbitrage

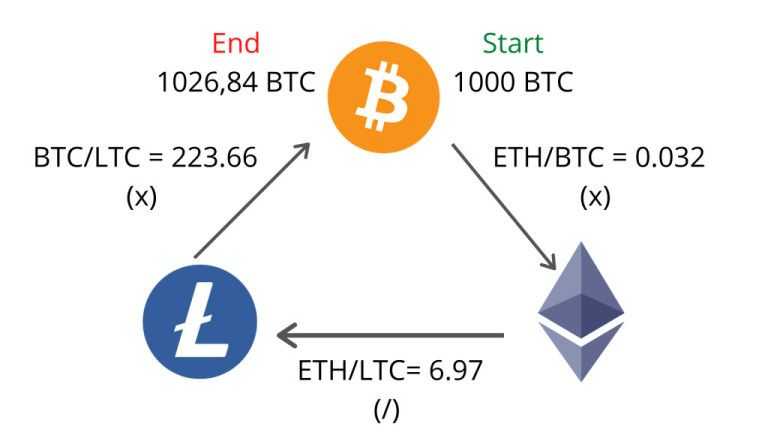

As the name suggests, triangular arbitrage attempts to exploit price discrepancies across three different assets. Traders can implement either a buy-buy-sell order or a buy-sell-sell order.

What does this mean in concrete terms? Let’s say that you start with Tether (USDT) and buy Ethereum (ETH). You then buy Solana (SOL) with Ethereum. In the final step, you would then sell Solana for Tether, thereby completing the buy-buy-sell triangle. With the same coins, a buy-sell-sell approach would involve beginning with Tether and buying Ethereum. You would then sell Ethereum for Solana, and, finally, sell Solana for Tether.

Latency arbitrage

Large institutional investors engage in what is called latency arbitrage, an approach to trading that allows them to take profit at the expense of slower trading investors. Profits result from exploiting low latency, or the time between when a signal is triggered and when it reaches its destination. In this case, we’re talkin about extremely fast speeds, typically fractions of a second. There is a widespread negative view of latency arbitrage, least of all because it costs retail traders an estimated $5 billion each year. In the case of latency arbitrage, individuals cannot compete against the trading speeds that institutional investors enjoy, putting them at a competitive disadvantage.

Spatial arbitrage

Often described as “geographical arbitrage,” this approach involves looking for price discrepancies between assets among geographically separate markets. In other words, a trader would compare the price of bitcoin on an exchange in North America versus an exchange in Asia (for example).

What is Arbitrage in Crypto?

The same principle applies to crypto trading. Let’s say that you buy bitcoin (BTC) on one exchange (Binance) at one price and then sell the same amount of bitcoin on another exchange (Kraken) at a better price. The difference in price across these two exchanges will result in profit, but that profit is often small, even negligible, making arbitrage something that a trader will need to do quite frequently in order to realize any substantive gains.

Arbitrage and Different Crypto Exchanges

In addition to the specific approach that you take to arbitrage, your choice of exchange may impact your profitability. For some traders, crypto exchanges without KYC (or “know-your-customer” requirements) are important. For others, the choice will be between a centralized exchange (CEX), a decentralized exchange (DEX), or even a hybrid exchange. Let’s take a brief look at the differences between them.

CEX

As its name suggests, a centralized exchange centralizes the buying and selling of cryptocurrencies, essentially functioning as marketplaces. Binance is the largest centralized exchange in the world, with an estimated 29 million users. The benefits of a CEX includes ease of use, convenience, and a range of trading options. However, users will pay for the convenience and variety, as the general rule of thumb is that centralized exchanges have higher fees than decentralized ones.

DEX

As you might have guessed, “DEX'' stands for a decentralized exchange in which a third-party marketplace is replaced by a peer-to-peer one. Some examples of DEXs include IDEX, Ox, Waves, Loopring, and Kyber Network. Rather than a middleman or intermediary such as Binance, traders have direct control over their funds and trading, which is accomplished via liquidity pools and smart contracts. The obvious advantages of decentralized exchanges, however, come with certain costs, namely the fact that traders are responsible for all aspects of their buying and selling of crypto, which might be off-putting for newer traders who are less confident about the process and their abilities to manage it successfully.

Having said the above, arbitrage on decentralized exchanges presents an interesting counterpoint to arbitrage on a centralized exchange such as Binance. Given the fundamentally different set of exchange-based rules governing the buying and selling of crypto, the results will necessarily differ. As Nansen, a blockchain analytics platform describes, traders can use a smart contract to execute a number of trades across various markets using only one transaction (effectively an “all or nothing” approach in which all trades go through or none do). More importantly, the ability to trade faster, which institutional investors often exploit, is mitigated by the fact that transactions depend on a chain’s block time.

“Arbitrageurs” (or those engaged in arbitrage trading) using DEXs should also be aware of the role of miners, as they decide the order of transactions, which is largely dependent on gas fees. As a result, “frontrunning” is a concern, as miners or others may take advantage of information gleaned from pending transactions to take profits for themselves.

Hybrid

In many ways, the underlying aim behind hybrid exchanges is to combine the best of both worlds, offering fast transaction speeds, security, and low fees. Two examples of hybrid crypto exchanges commonly mentioned are Nash and Qurrex. The Nash exchange has been described as hybrid DEX using off-chain order matching and trade settlement via a series of smart contracts. Qurrex, on the other hand, no longer seems to have a functioning website, or be a functioning hybrid exchange for that matter. Given the newness of hybrid crypto exchanges, traders are urged to proceed with caution, especially if engaging in arbitrage.

Drawbacks of Arbitrage Trading

Arbitrage in which a day trader exploits price variations across exchanges in order to make a profit is the ideal one. What happens, however, when things don’t quite go according to plan, as is typically the case in arbitrage trading? Below we’ll consider some of the many disadvantages when it comes to arbitrage.

Crypto regulations

In this instance, it’s more a matter of a lack of a global regulatory framework (or frameworks) governing the buying and selling of cryptocurrencies across borders. Regulatory gaps exist and there is an obvious lack of unified international standards when it comes to arbitrage, to say nothing of crypto trading in general. As a result, arbitrage can be a minefield for a trader.

Coins with the same ticker symbol

So you’re interested in trading BTCS. Is that Bitcoin Silver (BTCS) or Bitcoin Scrypt (BTCS). Or maybe you’re interested in SAI. Or is it SIA? Perhaps you’d like to add CMT to your portfolio (is that Comet or CyberMiles?). There are thousands of cryptocurrencies, many of which have the same or similar ticker symbols. Although it might seem like rudimentary stuff, it’s easy to confuse coins with identical symbols when engaging in fast-paced arbitrage trading.

Exchange wallets offline or on a different blockchain

Depending on a variety of reasons, ranging from security concerns to something as pedestrian as maintenance, exchanges can choose to disable their cryptocurrency wallets temporarily either for the entire platform or individually. Most cryptocurrency exchanges will have a fixed page where you can find out whether the wallet you need is on- or offline. If offline, the page might also tell you when it should be back online, and so it is always worth verifying before making any trades.

The second thing you should do is double check that the exchanges provide the tokens on the same blockchain. Sometimes cryptocurrencies will move from one blockchain, for example when EOS moved from the Ethereum blockchain to its own Mainnet, creating a situation in which there are two different wallet address formats.

High deposit, withdrawal, and trading fees

Centralized exchanges obviously benefit from their withdrawal fees, which can chip away at a trader’s profits, especially when individual gains are very small as in the case of arbitrage. It’s crucial to familiarize yourself with the deposit and withdrawal fees for both exchanges on which you trade. Not doing so will often result in the loss of any potential profit, rendering the entire exercise pointless.

Exchanges have a habit of regularly adjusting their trading fees, meaning that you might be enjoying low fees on your favorite pair one day, while the next you’re paying more for the privilege. For example, in 2019, Coinbase Pro hiked their fees by 200% for traders who they deemed to have “low volume.” Maker and taker fees both increased significantly in the general overhaul, too, leading to frustration.

Lack of volume

Before starting arbitrage, it is important to check that there is enough volume for you to execute the trade effectively on the respective exchange. Cryptocurrencies can and are often de-listed from exchanges due to low trading volume. With arbitrage, you can have a string of great trades, but one bad one can send things into a tailspin quite quickly. In addition, a coin can have volume, but you still might not be able to sell it at your target price. The ask price, bid price, and depth can be more important than the last price. And then there are transactions involving small amounts (known as “dust”), which are used to create the illusion of trading activity.

Pump-and-dump schemes

What would the crypto market be without its various scams, including so-called “pump and dump” schemes? In the aforementioned, scammers try to dupe traders by artificially inflating the price of an asset via feeding false information (e.g., fake positive news) and price action, the end result of which is to sell a large number of coins for a big profit. The last to buy is typically left holding the bag while the scammers have already cashed out. The age-old adage applies: if it’s too good to be true, then it probably is.

Approval bottlenecks on the exchange

If you’ve spent any amount of time in the cryptosphere, then you’ve likely come across traders who take to social media in order to complain that their deposits to an exchange have been stuck, requiring manual approval, or their exchange has simply been blocked. There’s nothing worse than having your eye on a trade and not being able to make it due to some form of bottleneck or approval process on a centralized exchange (or exchanges). In fact, it can often take days of back-and-forth messaging between a trader and exchange, making arbitrage all but impossible, until the problem has been solved.

Timing

Since timing is the name of the game with arbitrage, you’ll need everything to work perfectly. If one piece of the puzzle is missing or doesn’t quite fit with everything else, then the trade won’t happen. And when you factor in the crypto market’s notorious volatility, the arbitrage trader is often at a competitive disadvantage, which leads us to our final conclusion.

Crypto Arbitrage Is Not Ideal

When you add up the difficulty involved in trying to squeeze out small profits by exploiting price discrepancies across markets with the various pitfalls mentioned in the preceding section, it’s difficult to come to any other conclusion than the following: crypto arbitrage is a less-than-ideal way of trading crypto. To put it simply, crypto arbitrage opportunities can be few and far between.

While it is true that some traders will invariably be successful in executing arbitrage trades, there are simply too many moving parts involved in the process for it to be a viable path to profits. On the one hand, unregulated exchanges can hold or simply take your money quite easily. On the other hand, using regulated platforms can often lead to slow-moving deposits and transactions, defeating the purpose of arbitrage.

And if you’re manually day trading, then the best of luck to you!

The Best Alternatives to Crypto Arbitrage

The best alternatives to crypto arbitrage involve automated investment solutions, which you can rent or create yourself. Below are two innovative offerings from Trality, both of which you can start using right away to increase profitability and minimize risk.

The Trality Marketplace

Trality’s Marketplace is a unique space that brings together crypto trading bot creators and investors for mutually beneficial purposes. Until now, investors have had to rely on platforms that use anonymous bot makers and unproven bots. However, Trality’s Marketplace is an expertly curated space with hand-picked creators and the best bots available, enabling both creators and investors to earn solid passive income returns.

Access bots that outperform the market

Investors can rent profitable bots tailored to specific risk tolerances (low, medium, and high) and individual investment goals. A full suite of metrics is available, allowing investors to decide on a bot based on clear, quantifiable data. Bot Creators can monetize their bots and earn passive income from investors around the world by having their bots listed on Trality’s Marketplace.

Each Marketplace bot must pass a rigorous screening process by Trality’s in-house team of experts, who collectively have decades of industry experience. It’s this uncompromising commitment to a transparent bot evaluation process that distinguishes Trality’s Marketplace from generic alternatives providing merely “black-box signals.” At the same time, the Marketplace needs to be easy-to-use. Simply browse the bot listings, review the corresponding performance data and bot creator profiles, and select the appropriate bot.

For even more accessibility Trality has now partnered with Binance, the world’s largest and most trusted cryptocurrency exchange, to offer the Trality Wallet. Investors can add funds to the Trality Wallet using a preferred funding method and convert fiat to any of the over 350 cryptocurrencies directly within the Trality Wallet to start renting on the Marketplace right away—instant approvals for maximum flexibility.

Trality’s Code Editor

A world’s first, Trality’s state-of-the-art Code Builder is a browser-based Python code bot editor, one designed for experienced traders who want to develop sophisticated trading algorithms using the latest technology.

Python programmers immediately feel at home using the Code Editor’s full range of powerful tools and features when creating and backtesting algorithms. In-browser editing with intelligent auto-complete and in-browser debugging provide a seamless process for the development of trading ideas and their eventual realization as profitable trading bots.

With a full range of technical analysis indicators and a growing number of libraries, including NumPy, the Code Editor provides maximum flexibility for customizing bots based on a variety of market conditions and a variety of short- and long-term trading goals.

Blazing-fast, in-browser backtesting also means that testing and fine-tuning algorithms can be done quickly and easily. Benefit from clear versioning and backtest history, while also having access to financial data with easy-to-use API.

Final Thoughts

While crypto arbitrage can be a profitable trading strategy for advanced traders and under the right circumstances, the fact remains that arbitrage trading is very difficult to do for most traders. There are simply too many moving parts, too little room for error, and too few profits.

A far better approach would be to develop a trading strategy for a longer period of time and automate it using algorithmic crypto trading bots. An even more convenient solution would be to start copy trading crypto by renting profitable bots on Trality's exclusive Marketplace, where you'll discover innovative crypto trading bots built by experts for all market conditions.

Whichever approach you choose, be sure to do your own research and never invest more than you can afford to lose.

Disclaimer: The above article is merely an opinion piece and does not represent any kind of trading advice or suggestions on how to invest, how to trade, or in which assets to invest! Always do your own research before investing and always (!) only invest what you can afford to lose!