What Does Market Cap Mean in Crypto?

MORITZ PUTZHAMMER

26 January 2022 • 7 min read

Table of contents

If you’ve spent any amount of time following the news recently, then you’ll have read or heard about November’s “flash crash” or “Black Friday” event. As The Street reported, “The global cryptocurrency market cap dropped 6.1% to $2.78 trillion [...] wiping out roughly $169.5 billion according to back of the envelope calculations.”

A recent Reuters piece warned that “bitcoin's market capitalisation has fallen to about $931 billion from $1.25 trillion on Oct. 21.” And a Forbes article broke the bad news in no uncertain terms: “Of the four most valuable cryptocurrencies by market capitalization—excluding the biggest, Bitcoin, and Tether, a stablecoin pegged to USD—Ether fell 9.6% to around $4,300, Binance’s BNB 8.9% to $590, Solana 7.5% to $225 and Cardano 9% to $1.90.

As the saying goes, pride goes before the fall. Prior to the crash, many media outlets lauded crypto’s record-breaking market cap. For instance, Cointelegraph ran the headline, “Crypto markets tag $3T combined market cap for first time,” and Fortune gushed about crypto’s good fortune: “Cryptocurrencies hit market cap of $3 trillion for the first time as Bitcoin and Ether reach record highs.”

Whether shattering records or seeming to disappear into a black hole in a matter of days or even hours, crypto market cap is a perennial hot topic, which makes understanding it absolutely crucial.

What is Market Capitalization?

Definitions of market cap are all fairly standard and uniform. Investopedia describes it as “the total dollar market value of a company’s outstanding shares of stock,” which, as they note “is calculated by multiplying the total number of a company's outstanding shares by the current market price of one share.”

Calculating a cryptocurrency’s market cap is based on a similar logic, but with a key difference. Instead of using the number of outstanding shares, a coin’s market cap is calculated by multiplying the total number of coins that have been mined (circulating supply) by the price of a single coin at any given time.

Market cap = total number of coins circulating x price

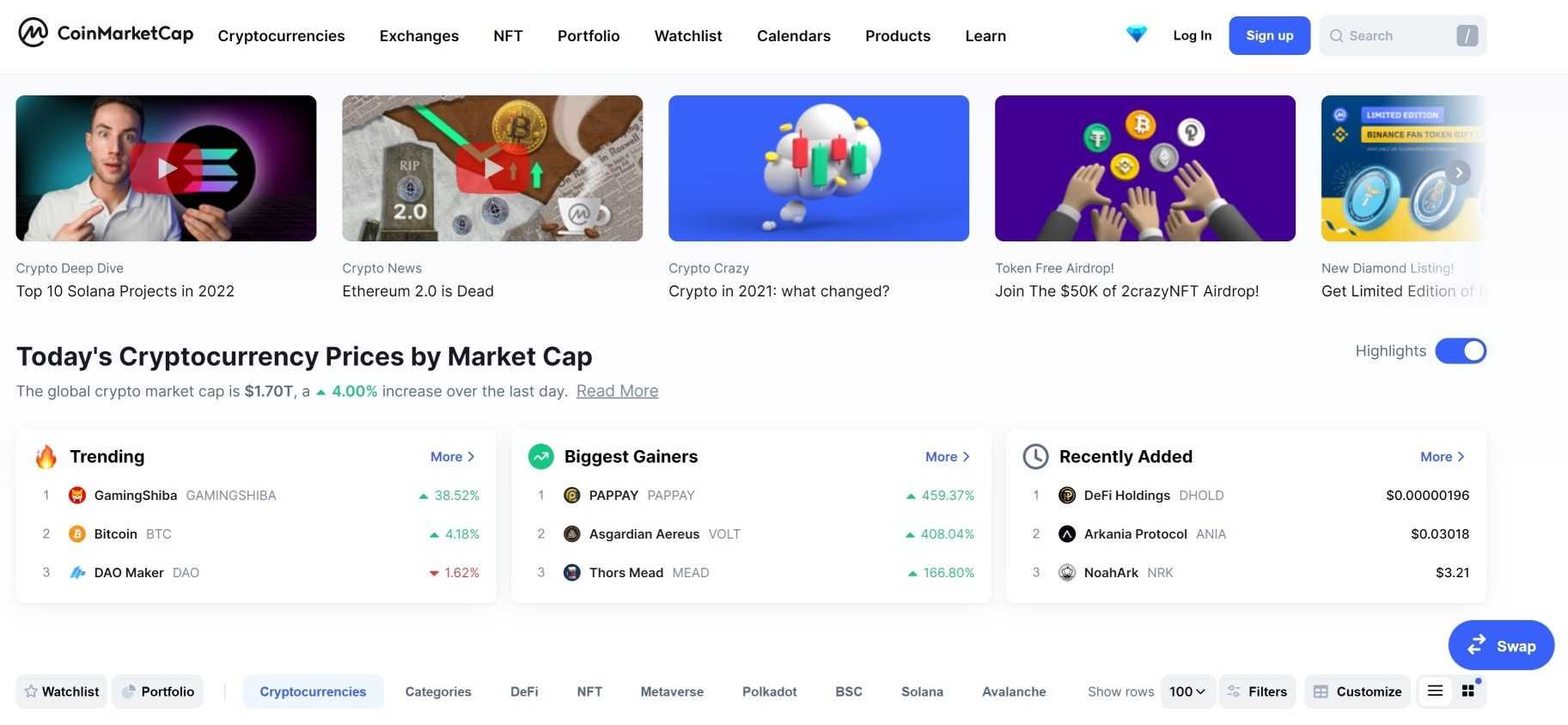

The most widely used website to obtain market cap information is CoinMarketCap, which provides a range of metrics related to cryptocurrencies.

When consulting CoinMarketCap, it’s important to keep in mind that the listed prices are calculated according to the volume-weighted average of all the prices from different exchanges. It’s also worth noting that some crypto watchers will make a distinction between circulating supply and fully diluted supply. In the case of Bitcoin, the magic number in terms of its fully diluted supply is 21 million, the point at which no further coins will be mined.

Why Does Market Cap Matter?

Traders must consider many factors when deciding on the relative strengths and weaknesses of any given crypto asset and whether it will be profitable over a specified period of time. One way to evaluate a coin is based on its price, but many novice traders tend to equate a high or low price with high or low value. Since the price of coin X far outpaces the price of other coins, then it must be a good investment, right?

The problem is the price is only one part of the value puzzle. Far more useful is market cap, which will give traders a more comprehensive overview in terms of a coin’s potential for growth and whether that coin is likely to be a risky or safe investment. For the sake of this discussion, let’s say that we are comparing two coins, one with a lower price but higher market cap, while the other has a higher price but lower market cap. On the face of it, the higher priced coin might appear to be a better investment, but its overall value is lower given its lower market cap.

Generally, the higher a coin’s market cap, the more dominant its position within the market. A coin such as Bitcoin with a large market cap also tends to be more stable than a coin with low market cap. In this respect, size really does matter. Low-cap crypto projects can fall prey to the whims of the market, sending their value into a fatal noise dive from which it might be difficult, if not impossible, to recover. The flip side, of course, is that there is much greater potential for tremendous gains during bullish market conditions when trading low-cap coins.

Market cap categories

As the summary above indicates, there is a hierarchy of market capitalization, which is generally arranged according to three categories: large cap, mid cap, and small cap. Given their status as the “gold” and “silver” of cryptocurrencies, for example, Bitcoin and Ethereum are large-cap (more than $10 billion) and therefore considered to be lower risk investments because of their demonstrated history of growth and high liquidity. Mid-cap coins (between $1 billion and $10 billion), then, have a smaller market cap, but carry more risk than their large-cap cousins. As a result, many see them as having more potential and more risk. And small-cap cryptocurrencies (less than $1 billion) have the smallest market cap and highest risk.

Nevertheless, high-cap coins can still be quite volatile. During September 2021, Bitcoin’s price fluctuated between $45,000 and $55,000, which resulted in significant market cap variations. If we use 18.8 million as its circulating supply, then we can clearly see the extent of the volatility:

Market cap = total number of coins circulating x price

- $846 billion = 18.8 million x $45,000

- $940 billion = 18.8 million x $50,000

- $1.034 trillion = 18.8 million x $55,000

What Affects Crypto Market Cap?

Mirror, mirror on the wall, which coins will have the largest market cap of them all?

In addition to crypto news websites, there’s a good chance that you’ve spent some time lurking among the various Reddit crypto communities, where there never seems to be a shortage of questions about any given coin’s present or future market cap. Take this one from the Cardano community, for example (no offense to Cardano enthusiasts!):

The commenter is right. A $4 trillion market cap for Cardano does indeed seem “a bit high.” If it were to happen, then Cadano’s market cap would be almost twice as large as Apple’s, the company with the highest market cap in the world. The question being asked isn’t necessarily whether Cardano’s market cap will rocket to the moon (or to another galaxy), but rather what actually affects market cap.

Tokenomics

As we know, cryptocurrency market capitalization involves two key components, the total number of coins circulating and a coin’s price. Let’s first consider a coin’s circulating supply. Within the world of cryptocurrencies, this is often referred to as “tokenomics,” or the quality, distribution and production of crypto tokens. Since Bitcoin’s supply is limited to 21 million, its demand is expected to increase as its scarcity increases. However, one consequence of increased scarcity will be increased hoarding, resulting in a reduction in circulation or trading volume.

Conversely, a project with a much higher number of coins, say Algorand and its 10 billion max of ALGO, might deliberately suppress its price by drip-feeding the market with coins over a long period of time in order to avoid high volatility as a result of pump-and-dump schemes (e.g., whales buying up a large number of coins in order to drive up the price and then dumping the coins for profit). In this case, a stable uptrend over a longer time frame is more preferable than a high-risk, high-reward, high-volatility approach.

At the other end of the “hard cap” spectrum is Dogecoin, which is considered to be inflationary (as opposed to deflationary like Bitcoin or, in the case above, ALGO). Since its numbers are designed to increase at a set absolute rate of five billion each year, Dogecoin’s supply is theoretically infinite, although the actual supply will likely reach a practical limit. Its predictable growth rate also means that its price should be easier to predict, resulting in a definite use-value proposition as a legitimate currency in light of its projected stability.

Feel the burn

Another aspect of tokenomics and market cap involves coin burning. As its name implies, miners burn tokens in order to decrease supply and therefore increase or stabilize a token’s price. However, reducing supply doesn’t necessarily ensure an increase in price in the absence of a corresponding demand for the token. There are other reasons for coin burning aside from supply and demand, including achieving a more effective consensus through “Proof of Burn” (PoB), safeguarding against attacks (e.g., DDOS), and demonstrating commitment to a project’s longevity. Quite a number of projects, such as Bitcoin Cash, Ripple, Binance Coin, Stellar , USDT, and USDC, have used coin burning. More recently, Ethereum Network Burned Over $2.4 Billion Worth of ETH in 87 Days, amounting to 702,886 Ethereum burned since the London hard fork.

Cryptocurrency and value

The other component of our market cap equation is a coin’s price or value, and there are a range of factors to consider. What’s the connection between the services being built on any given blockchain and the coin itself? Is it a governance token? Utility token? Security token? Price is also impacted by the cost of production, availability on exchanges, governance, and regulatory environment.

In addition to supply and demand, these include things like competition, technological developments, media hype and the celebrity touch. It’s an interesting topic and you can find out more about it in our article “How does cryptocurrency gain value?”

To (Market) Cap It Off

As we have seen, cryptocurrencies – even large-cap ones – can be extremely volatile, with market cap being just one criteria among many when evaluating trading options. However, you should now have a much better understanding of what market cap is, why it matters, and what affects it. Nevertheless, the golden rule still applies: do your own research (DYOR) and only invest what you can afford to lose.