Ethereum Price Predictions for 2022-2025

DECLAN IGOE

01 January 2022 • 11 min read

Table of contents

Ethereum ($ETH) is the second most valuable token when measured by market cap, and the Ethereum platform offers its users a wide array of tools. Unlike Bitcoin, which was aimed solely at making financial transactions, the Ethereum blockchain was designed to do a lot more.

The blockchain that powers Ethereum is far more complex than Bitcoin and allows third-party developers to create their own tokens and sub-platforms on the blockchain. This has led to a steep rise in the popularity of Ethereum, although it has also created issues for some devs that decided to invest in creating new platforms on blockchain which means making an accurate Ethereum price prediction requires a holistic approach.

ETH in a nutshell

ETH is the native token of the Ethereum blockchain. While Bitcoin was designed to be money, Ethereum was aimed at a much wider range of potential uses. ETH tokens make the whole blockchain work and are needed to do anything on the Ethereum blockchain.

For the moment, ETH uses a Proof-of-Work (PoW) system that is similar to Bitcoin to approve transactions and maintain the blockchain. This may be changing over the next few years with the advent of ETH 2.0, although the roadmap to implementing the new Proof-of-Stake (PoS) system isn't well defined.

While the ETH token wasn't necessarily designed to be used solely as a currency, it has become a popular means of both savings and payment. Ethereum also has a robust ecosystem that is one of the most important tools that Decentralized Finance (DeFi) devs have currently.

How has the price of ETH performed in the past?

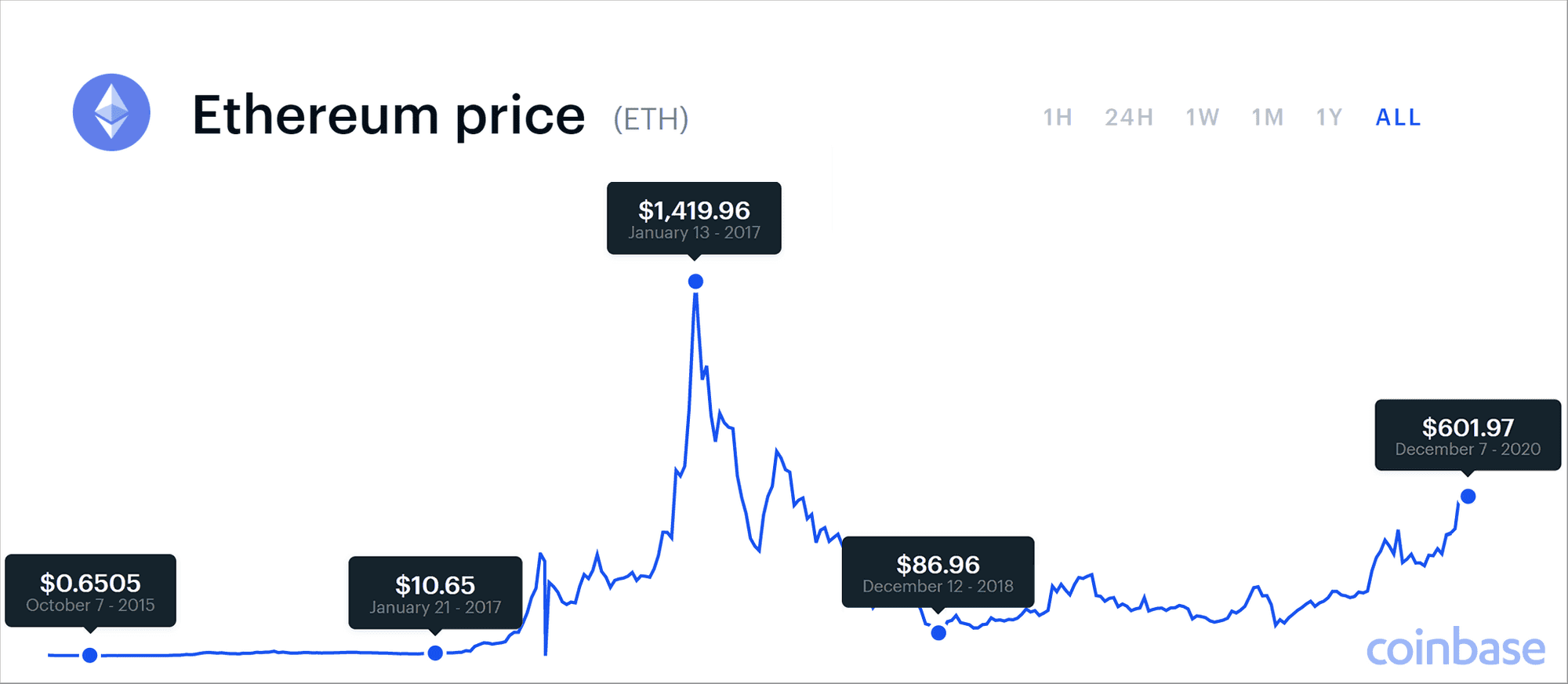

ETH's price records go back to late 2015 when it was trading on the open market for less than $1.00. It was able to stage a modest rally into the $10.00 area by January of 2017, which is when the real fun began. ETH prices went on a breakneck rally to over $1,400 per token in January of 2018, when it entered a bear market that would take the price as low as $87 by the end of 2018.

After the fall to double-digit prices, ETH traded sideways for a year and a half. The token seemed to be capped at $250 during this time, but it also seemed to be finding buyers at the $100 level.

In July of 2020, the $250 level was overcome on heavy volume. ETH traded as high as $475 in September of this year, before falling back to test the breakout at the $320 level. From there, ETH has rallied to over $600 in late 2020, and the chart for the token looks bullish, as it has been able to break out of a multi-year trading range on massive volume.

What factors affect the price of ETH

Ethereum is a complex platform that is influenced by many different factors. Because Ethereum's blockchain is built to encourage third-party development, new platforms that run on the network can have a big influence on the price of ETH tokens, and transaction costs on the platform.

One of the biggest things that may have driven ETH out of its trading range in the middle of 2020 is the DeFi boom. While ETH isn't necessarily used by all these new DeFi platforms as a means of transaction, many new DeFi platforms are built on the Ethereum blockchain, which means that some amount of ETH is needed for the DeFi tokens or platforms to operate.

The use of Ethereum as a base for DeFi applications resulted in net demand for the token, which was clearly good for the price.

Curiously, as the DeFi bubble went bust in the fall of 2020, ETH prices remained elevated, and trading volumes were higher than at the beginning of the year. All of this points to other sources of demand for the token, as well as a limited connection between DeFi token prices, and ETH prices.

As 2020 unfolded, demand for alternative assets rose. As the second most valuable token behind Bitcoin, ETH has become an investment asset for many institutional investors who are entering the crypto markets.

New ETH buyers aren't looking for a quick profit

While DeFi developers may not be using ETH as money (some are, but many aren't) institutional investors are using ETH as digital gold and holding the token for the long haul. Grayscale Investments, a leading crypto investment company, has raised record amounts of new investment capital in 2020, much of which flowed into long-term ETH holdings. The investment model that Grayscale offers isn't complex. The company buys and acts as a custodian for client funds, which basically means that the ETH is being put into cold storage as a reserve asset by large investors. As the basis of DeFi, at least for the moment, ETH is a vital part of an emerging ecosystem that is global in scope.

It is very hard to overstate the role that DeFi could have in the financial landscape of this century, and Ethereum's blockchain is a core part of the DeFi development space. While the platform's popularity did affect some applications that relied on low network fees to operate, many DeFi platforms wouldn't be impacted by marginally higher transaction fees.

As price action in the latter part of 2020 has shown, lower DeFi token prices don't mean less demand for ETH, and as a new reserve asset for the wider financial community, ETH has built-in support that many DeFi platforms lack.

NFTs are growing in popularity

In addition to DeFi, Ethereum is also used as a base for crypto gaming, and the Non-Fungible Token Revolution (NFTs). Tokens like BTC and ETH are fungible, that is to say, all of them are the same. However, Ethereum's blockchain supports the use of NFTs, some of which are created by using the ERC-721 protocol.

The market for NFTs is vast, and they are already finding a home in the gaming and digital art worlds. In the world of gaming, these tokens can be used to create unique items, which can be 'owned' by a gamer. This model stands in stark contrast to traditional centralized game development, where the platform's owner controls all the in-game items.

Because many NFTs are created with the ERC-721, they can be easily traded for other tokens, like ETH or BTC. In a sense, there is already a marketplace for these game items, which could be very attractive to the next generation of gamers.

In the art world, NFTs have been used to both represent artworks, and also to hold unique works that are token-based pieces. Art NFTs have already proven successful, with an NFT holding a portrait of Vitalik Buterin selling for more than $400,000 at public auction.

Ethereum price prediction for 2022-2025

The next four years will likely be positive for crypto prices, and ETH is leading the altcoin pack. With its break above the $280 level in the middle of 2020, ETH smashed out of its post-bear market trading range and is probably going to much higher levels over the next few years.

It is easy to see that ETH prices engaged in a long bottoming process that began in late 2018 and lasted until mid-2020. With the break above $300 on massive volume, ETH is signaling that a new bull market is probably here. Given the backdrop of easy central bank money and government spending programs, ETH prices may be able to rise to levels that are difficult to imagine at the moment.

One of the most important factors that are driving the phase shift in the crypto markets is the adoption as a stand-alone investment by institutional investors. While Bitcoin has traditionally been the favorite of crypto investors, large investors from the established markets don't have the same convictions concerning decentralization.

Instead, these investors are likely to favor a growth model, and also reward platforms that offer the ability to innovate. In short, ETH is the perfect platform for investors that want both the ability to hold a token as money and benefit from the rising use of the platform by third-party developers with new ideas.

Given the interest in Ethereum's blockchain by developers and investors, it isn't hard to see a scenario where ETH prices climb to between $1,000 and $10,000 over the next four years. One of the biggest unknowns going forward is central bank policy, which has been very difficult to predict over the past decade, especially in 2020.

As ETH is becoming a cash-like reserve asset for established investors, it is highly likely that 'fresh money' that would have flowed into equities or debt may now find a home in long-term ETH holdings. While ETH is gaining in value, its total capitalization will well below $100 billion USD.

With the current float of ETH in the markets, a $6,000 price would imply a capitalization of around $650 billion, which is still low when compared to a single company like Apple or Alphabet. Of course, the potential uses for ETH's blockchain are far wider than either of these two companies' products or services.

Given ETH's relatively small capitalization at the moment, the potential for an explosive rise in price at any time is very real. Mainstream payment platforms are opening the door to crypto use, and the technology to use tokens like ETH at a retail level is in place. It is very difficult to predict how high ETH prices will go in the coming years, but the direction is certainly up.

Other Factors That Could Affect The Future of ETH

The Ethereum blockchain is on the cusp of making some major changes. The ETH 2.0 project is now fully funded and will begin work on a project that is designed to make a shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS). When Ethereum was designed, it used the same way to validate blocks that Bitcoin uses, which is PoW.

A PoW system has some major drawbacks, which is what the PoS is designed to address.

No one really knows what will happen as these upgrades are introduced, and they will include a net gain to the amount of ETH in the marketplace. The amount of ETH that will be added is at least 4 million tokens, at least according to new estimates. At its most basic level, this upgrade to ETH 2.0 is a gamble, but if it is successful, ETH will be the most capable public blockchain there is.

Some of the most important problems that a PoS system addresses are the ability of bad actors to mount a 51% attack and the huge amount of energy that is needed to operate a PoW blockchain. There is a lot more, but given the relative infancy of these programs, it is almost impossible to know how they will be implemented, or what effects they may have.

From an investor's point of view, PoS is a much better system. A PoS system creates many more opportunities for passive income, as the holding of a token becomes inherently valuable. Staking on a PoS platform can be thought of as making an interest-bearing deposit, as large stakers are able to earn rewards via their staked tokens.

Smaller stakers who don't participate directly in the validation process can still earn by entering into fixed-payment smart contracts with a validator, which could be a more or less automatic process for any ETH holder that was interested. Overall, ETH 2.0 could be a massive opportunity for digital investors, although no one knows how it will unfold in the coming years.

The bottom line: Is ETH a good investment in 2022?

The crypto markets remain as volatile as always. Although the Ethereum price prediction is looking positive for a year from now, the path to those higher prices is probably going to be full of fast moves down. Bull markets tend to have quick corrections and as ETH is likely entering another bull run, sharp moves lower will most likely enter the markets every so often. ETH is one of the leading tokens globally, and there is no doubt that institutional investors see it as a similar asset to Bitcoin. Given the fact that established investors are entering the digital asset space in higher numbers, ETH should have buying support over the next few years.

Should you buy ETH today? Probably, yes. But keep in mind that the crypto markets move more like the commodity markets, and you will probably want to use an accumulation strategy that spreads your buying capital out over months or years.

From a technical standpoint, ETH looks like an incredible buy. The token has put in a long and well-tested bottom, which it broke out of decisively. With the high volume move above $300 in the summer of 2020, ETH has opened up the door to much higher prices.

Keep in mind the initial rise in ETH prices to around $475 resulted in a fall to the $320 level, so buying a position in stages makes more sense than making a one-off buy in the market.

On the fundamental side, the introduction of ETH 2.0 in the coming years is encouraging. Unlike Bitcoin, ETH could become an asset with a naturally occurring rate of return due to its emerging PoS model. This would make it more attractive to many investors who want to generate a risk-free passive income, although this system is still years away from being a reality.

The biggest worry with ETH is that the price may fall suddenly, which makes it a poor choice for anyone that is looking for a cash equivalent.

If you do want to keep a substantial amount of value in the token, it would be a good idea to hedge whatever amount of value you need to have on an on-demand basis, so that short term down moves don't create issues for your cash-equivalents position. If Ethereum is not for you then take a look through our top picks for cryptocurrency investments in 2022 where you can find out about a range of other interesting projects.

Trading in the long term requires a lot of time and commitment if you want to see any serious profits. The cryptocurrency world is always awake and you can’t always react to the tremendous waves of volatility but there is a way to make your strategies work 24/7. With a trading bot, you can ride the ups and downs of the market emotion-free and more efficiently than a human can ever do. Trality has tools that allow anyone to benefit from automated cryptocurrency trading with or without coding knowledge.

Trality Rule Builder (zero coding knowledge needed)

The Rule Builder is a unique product that allows you to drag-and-drop segments to create your own trading bot. It allows traders to easily create and backtest trading their strategies. It’s very easy to use, it comes with pre-defined trading strategies and once you decide which strategy to go with, it takes just one click for you to start live trading. You can build upon curated, pre-defined trading strategies, and select from over 100 technical indicators to use Boolean logic and arrange your strategy parts. Once it’s all ready simply, backtest your strategy with historical data to see how your bot performs.

Trality Code Editor (Python coding knowledge required)

Trality Code Editor is the world’s first browser-based Python Bot Code Editor, which comes with a state-of-the-art Python API, end-to-end encryption, and more. If you are looking to build a profitable trading algorithm in Python, the Code Editor is the one. You can edit in-browser with intelligent auto-complete to help speed up the process. The Code Editor boasts in-browser debugging and you will benefit from the use of clear versioning and your backtest history to really fine-tune your code.

Disclaimer: None of what is found in this article should be considered investment advice. Much of the above analysis is based on already-released news, expected future developments, and pure speculation. While we can analyze what we have seen in the past, we can not predict the future. This article also may become out of date at some point and fail to reflect current, updated prices and information. Always do your own research before investing and always (!) only invest what you can afford to lose!