Crypto Trading Bots: The Ultimate Beginner's Guide

MORITZ PUTZHAMMER

28 June 2022 • 14 min read

Table of contents

Time waits for no one and financial markets are no different, especially when it comes to the unpredictable world of cryptocurrency trading, which is why a carefully calibrated, safe and reliable trading strategy is essential. Unlike traditional stock markets, cryptocurrency trading never stops, making it virtually impossible for private traders to track market fluctuations, diversify risk, reduce error and ensure trading discipline 24 hours a day, 7 days a week, 365 days a year.

Unless, of course, you have some help, which is where crypto trading bots come into play.

What is a Crypto Trading Bot?

A bot is simply an automated program that operates on the Internet and performs repetitive tasks more efficiently than humans. In fact, some estimates suggest that more than half of internet traffic is made up of bots that interact with web pages and users, scan for content, and perform other tasks.

Crypto trading bots operate under the same basic principle. They’re software programs that execute functions using artificial intelligence based on pre-established parameters. No more missed trades or missed opportunities. Whether you want to buy into the most undervalued cryptocurrencies or simply add new crypto coins to your portfolio, you can automatically buy, sell or hold assets in a timely, efficient and automated manner day or night from anywhere in the world simply by using crypto trading bots.

Fake promises about high returns: how to avoid fake crypto bots

The first thing to understand about how crypto trading bots work is that not all bots are created equal. The vast majority of crypto trading bots available on trading platforms are made by anonymous bot creators interested in selling their generic bots to as many people as possible. Often, users will be lured by promises of high returns, but without any substantive data to back such claims. In fact, many crypto trading bots are just scams. Often, you’ll have no idea how or even if the bot actually works because you won’t have any data about it or its creator. This is how bots don’t work for you.

How Do Crypto Trading Bots Work?

In order to trade with a crypto bot on a crypto exchange, you must authorize the trading bot to access your account via API keys (Application Program Interface), and access can be granted or withdrawn at any time. So what about the actual mechanics of a profitable crypto trading bot? By communicating directly with crypto exchanges and placing orders automatically based on your own preset conditions, trading bots created on Trality offer exceptional speed and efficiency, fewer errors and emotionless trading tailored to your individual risk tolerance and investment goals.

Broadly, trading bots work in four essential stages: data analysis > signal generation > risk allocation > execution.

- Data is king, which is why data analysis is crucial to the success of a crypto trading bot. Unlike humans, machine learning-enabled software can identify, gather, and analyze mountains of data faster, smarter, and better.

- Once the data analysis has been completed, signal generation by a bot essentially does the work of the trader, making predictions and identifying possible trades based on market data and technical analysis indicators.

- Risk allocation is where the bot distributes risk according to a specific set of parameters and rules set by the trader, which typically includes how and to what extent capital is allocated when trading.

- Execution is the stage in which cryptocurrencies are actually bought and sold based on the signals generated by the pre-configured trading system. In this stage, the signals will generate buy or sell orders, which are sent to the exchange via their API.

Do Crypto Trading Bots Really Work?

In a word: Yes!

The financial industry has been raking in record profits for decades by using automated trading strategies. In fact, within the past decade, algorithmic trading bots have overtaken the entire financial industry, with algorithms now responsible for most of the trading activity on Wall Street.

The question, then, isn’t whether they work, but rather well they work. And their effectiveness largely depends on a number of factors, including the platform and bots that you choose as well as your levels of expertise and experience.

Advantages of Crypto Trading Bots

Why should you care about automated trading bots? Two words: Wall Street. Many reports suggest that around 80% of trading on the stock market is done via algorithmic-based automated programs. The upper echelon of the financial world have been using automated trading for decades, but private investors have been locked out because of the technology’s extreme costs and complexity.

That’s why comparatively few private traders make use of algorithmic trading. Not everyone is an experienced Python coder or financial expert, but Trality is leveling the playing field by combining the latest cutting-edge research in artificial intelligence and machine learning to offer users the very best crypto trading bots available anywhere.

Let’s take a look at some of the most important advantages of crypto trading bots.

Emotionless trading

You’ll often read that more than 80% of private traders lose money due to a variety of factors. Trading volatile cryptocurrencies is emotional work and with emotions come errors in judgment. As much as 39% of manual trades are influenced by our emotional states, which can cause us to make irrational decisions. It’s simple human psychology.

Choose instead to be among the 20% of smart traders who make money by harnessing the power of trading bots to ensure a non-emotional, systematic approach to trading.

Higher trading speed

Time is money. And when it comes to speed, bots are simply faster: millions of computations and thousands of transactions across various time zones and markets almost instantaneously. Trades happen in a fraction of second – far faster than anything an individual trader can accomplish.

In the time it takes you to read this sentence, a trading bot could have made multiple profitable trades for you.

Backtesting and paper trading

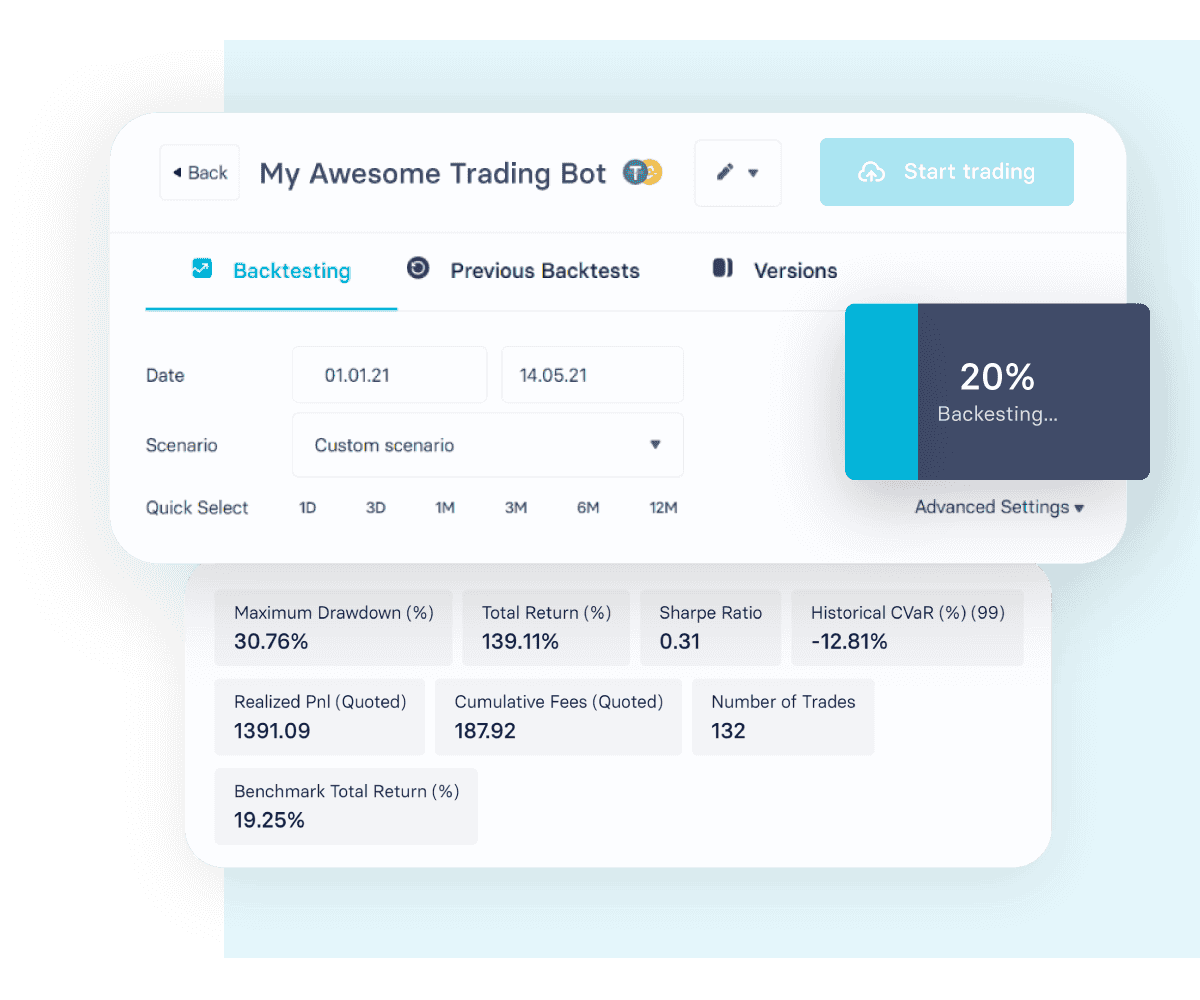

Pilots learn to fly with flight simulators, and traders should be using market simulators when learning to trade for the exact same reasons. We learn by doing, but we don’t want to lose money (or crash an expensive plane) in the process. Even experienced traders can reap the benefits of trading simulators.

With trading bots, backtesting and paper trading allow you to harness the power of historical data to simulate the viability of a particular trading strategy or pricing model. The point is not to predict the future (after all, we’d all be rich by now), but to determine how well (or poorly) a particular trading strategy is likely to perform based on historical data. Armed with a reliable backtesting tool and an accurate set of data, you can explore new strategies, add expertise and build confidence before you’re ready to put your money on the line.

Risk diversification

If you’re looking for a get-rich scheme, then you’re better off heading to Vegas.

Trading bots are about minimizing risk by not putting all of your eggs in one basket. We all know that cryptocurrency markets can be highly volatile, which is why a prudent trading strategy should include risk diversification. One way to diversify your risk is to run multiple trading bots. And while a diversified portfolio is certainly not foolproof, it can balance risk and reward in order to reduce exposure to any one particular asset. Age-old advice that still rings true with cutting-edge technology like trading bots.

Consistent trading discipline

Learning a language, finishing a marathon, becoming a Zen master. They all require one thing: discipline. And trading is no different.

But discipline is difficult (how many Zen masters do you know?). By automating the trading process, however, bots ensure consistent trading discipline even in volatile markets when fear can lead you to sell or luck can cause you to buy. Because of pre-established trading rules, bots optimize long-term performance without the short-term costs of emotional human interventions.

Disadvantages of Crypto Trading Bots

Crypto trading bots aren’t an instant path to success, though. They’re automated, but not automatic. In order to build a profitable crypto trading bot, traders must understand that the process of creating a good bot takes clear goals, patience, and knowledge as well as a certain degree of trust, which is why it’s crucial to avoid one-size-fits-all bots from unknown sources.

If you’re interested in renting a crypto bot rather than creating one, you’ll also need to remember that most crypto trading bots being offered by some of the most popular platforms produce marginal returns. To put it less diplomatically, most crypto trading bots are poorly designed. In an effort to attract users, platforms will list bots for rent without thoroughly testing them under different market regimes.

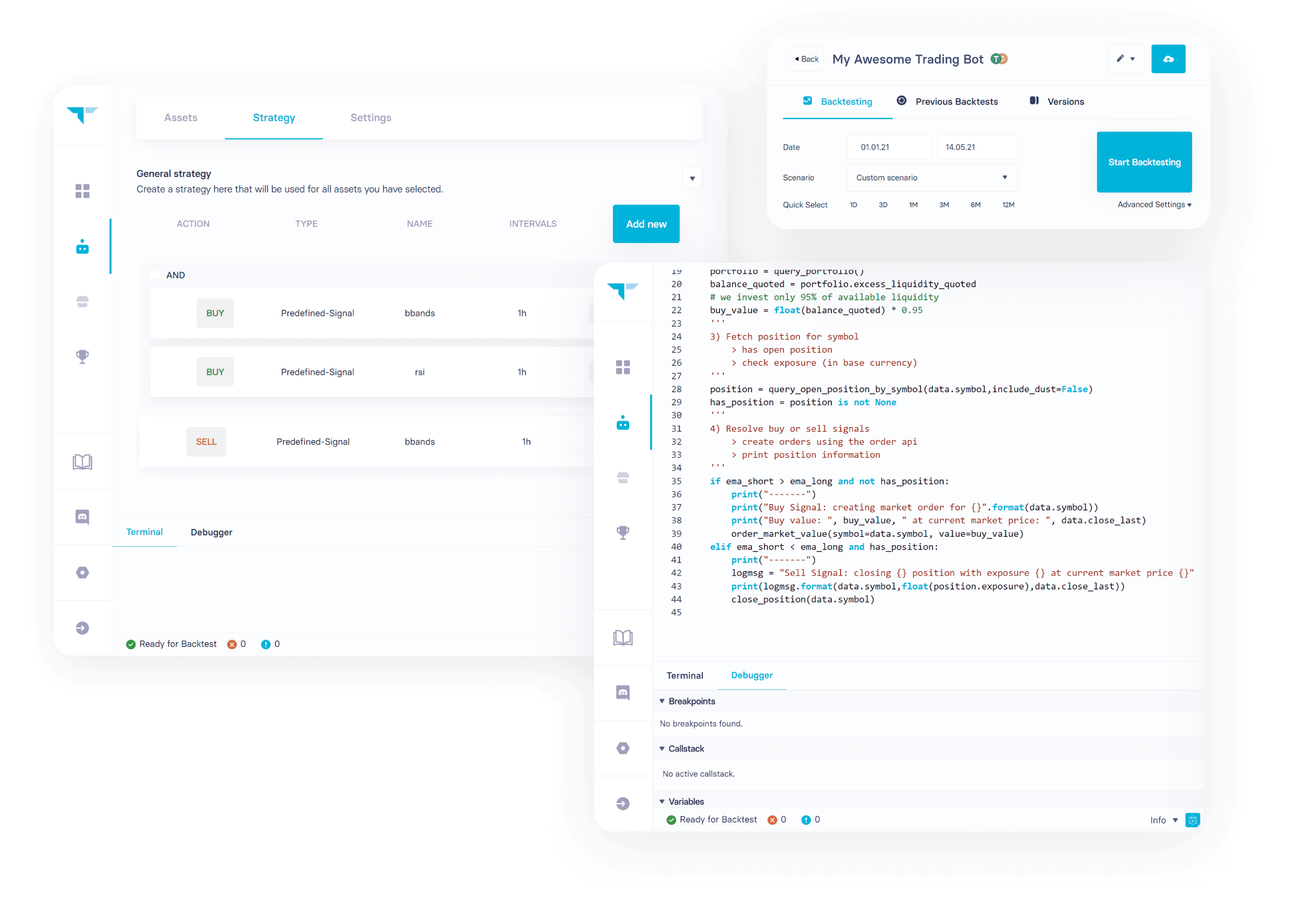

Create Your First (or Next) Crypto Trading Bot with Trality

If you prefer to create your own crypto trading bot, then Trality offers the most comprehensive array of user-friendly tools to help you achieve your trading automation goals. With our easy-to-use UI/UX you can create, backtest and trade like a professional, whether you’re a casual trader, python guru or an absolute beginner.

Trality’s Rule Builder

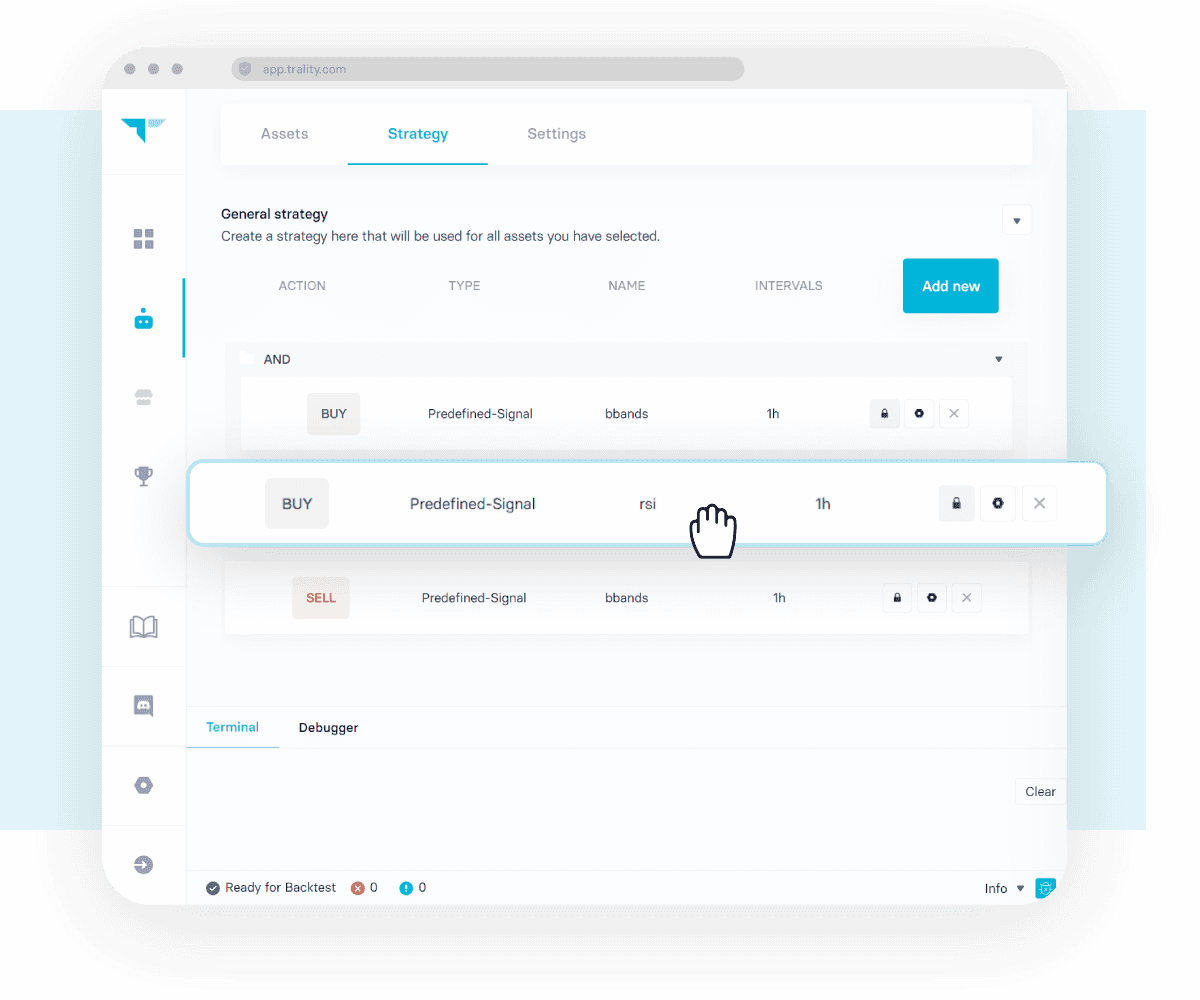

Trality provides a platform for bespoke bot creation, with easy access for everyone. If you’re unsure about your coding skills, simply use our handy Rule Builder to create flexible bots using boolean logic (no coding is required).

Its graphical user interface lets you build your trading bot’s logic by simply dragging and dropping indicators and strategies. You can also choose from a variety of predefined strategies that you can customize to your liking right away. If you need any additional information or explanations, then check out Trality Docs, where we explain everything in plain English.

Trality’s Code Editor

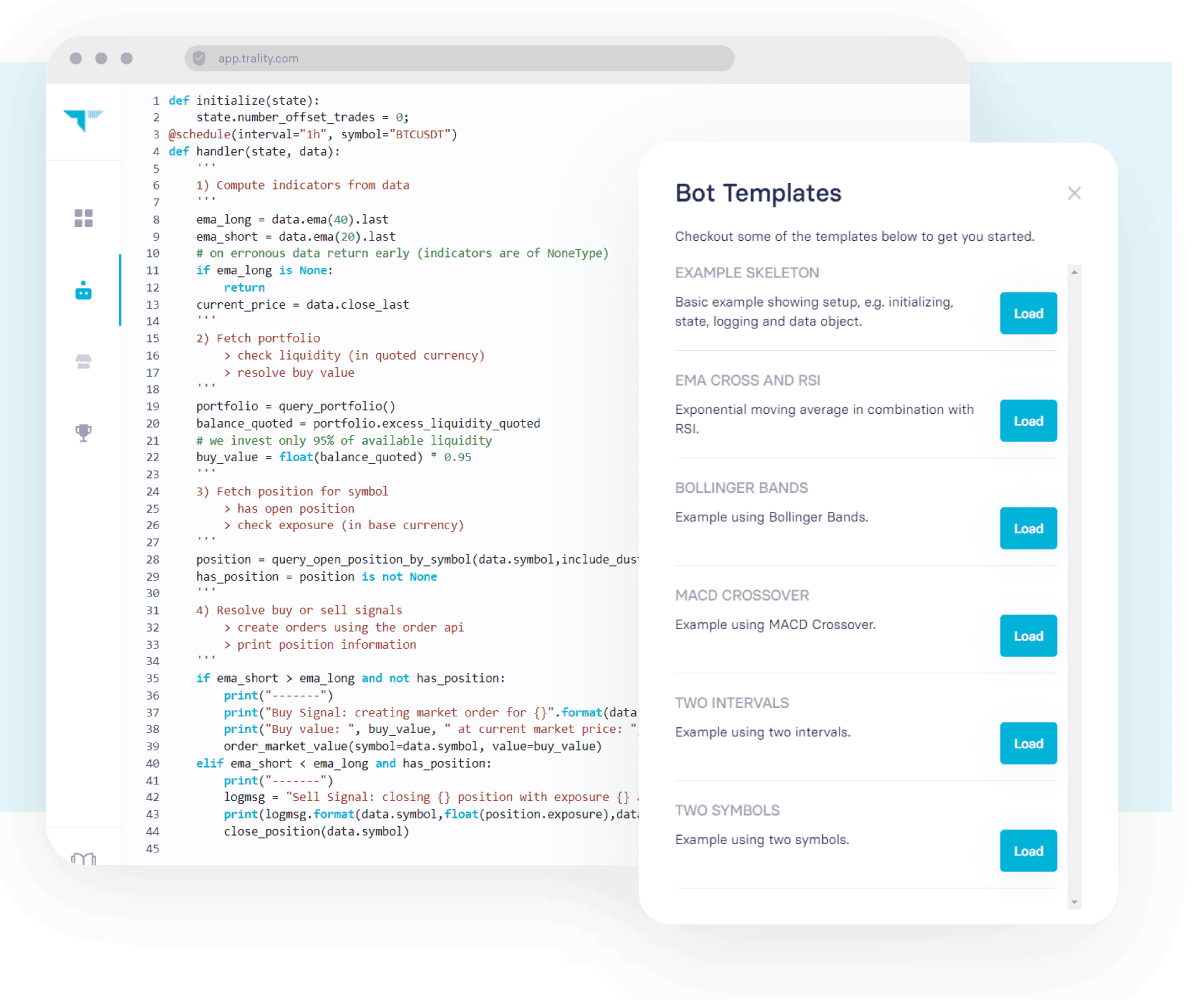

For more advanced users, Trality is proud to offer the world’s first browser-based Python Bot Code Editor, which comes with a state-of-the-art Python API, numerous packages, a debugger and end-to-end encryption. Additional benefits include accessing financial data with our easy-to-use API as well as access to a full range of technical analysis indicators.

Once you’re satisfied with your strategy and backtesting results, you can deploy your bot for live-trading or paper-trading on your favorite exchange.

The safety of your funds is paramount to us. We are committed to safeguarding your investments, which is why Trality never touches your funds directly. Bots merely send trading signals to your trusted exchange. Withdrawal-enabled API keys will always be rejected. All crypto bots and algorithms are completely sandboxed and are end-to-end encrypted. And since our service is cloud-based, there’s never any need for additional installations. Create, backtest and deploy your crypto bot in one streamlined interface.

How to Create the Best Crypto Trading Bots

Now that you’re familiar with trading bots and how to create one using Trality, we’d like to highlight some of the best practices for creating successful crypto trading bots. Stefan Haring, Director Risk & Portfolio Analytics, has written an informative blog series for us about the conceptualization, development and implementation of a multi-coin trading bot start to finish. It’s an excellent resource for understanding the various moving parts of trading bots, and below are some key takeaways as well as a few key additions.

Crypto Trading Bots and Timing

Perhaps two of the most crucial elements of how crypto trading bots work are trade entries and trade exists. Here we’re moving away from the basic mechanics of how they operate and into a basic discussion about the underlying principles at work when leveraging bots to trade profitably or minimize trading risks. When thinking about trade initiation, the general idea is that price is not the same thing as value, and it’s the bot’s job to decide the difference between the two. As Warren Buffet famously said, “Price is what you pay; value is what you get.”

In other words, the position is a proxy to confidence in the predictions being made about any given crypto asset, and these predictions have two possible outcomes. Any given prediction will be either correct (take profit) or incorrect (stop loss), which is why it’s so important how and when this decision is made. It’s also important to pair the right strategy with the right market regime, as specific strategies target specific market conditions. Certain automated strategies, for example, will work well in a bull market, but not in a bear or sideways market (and vice versa).

Trade entries for crypto trading bots

Trade entries involve various types of signals or indicators in order to time entries. Indicators come in all different shapes and sizes. There are literally hundreds of them, with a seemingly infinite number of combinations that trading bots can use to enter positions. If you’re interested in learning more about them, then you can always check out Trality’s FREE Masterclass (available to all Trality users), where we 1) take a look at the main categories or groups of indicators, 2) focus on a number of core ones that should be on every trader’s radar, and 3) see how to use these indicators on Trality’s platform.

Trade exits for crypto trading bots

Just as a well-timed entry is important, so too is an opportune trade exit. Leave your position too soon and you could be missing out on additional profits; leave it too late and you could be losing money unnecessarily. A “good case” of a trade exit, then, is known as “take profit,” while a bad case is considered a “stop loss. All in all, the crypto bot, its indicators, and overall strategy will need to align with the right market regime. Just as you wouldn’t use a hammer when a screwdriver is needed, you should match the correct crypto trading bot with a specific market condition.

Backtesting is the backbone of any successful trading strategy/system

We cannot stress this enough: backtesting is absolutely crucial. You’ll likely learn more from one hour of backtesting than from one year of live trading.

As Stefan Haring writes, ‘When running a backtest, it is particularly important to split the time period that is available for backtesting into in-sample and out-of-sample data. We use the in-sample data to optimize our strategy and, once we are satisfied, we use the out-of-sample data to validate our results and make sure that we do not just end up with an overfitted strategy that will likely perform poorly in actual live trading.’

Past results are not indicators of future performance

Let’s say that your bot has performed exceptionally well during backtesting. That still does not guarantee that it will continue to perform well after it has been deployed live. You should monitor its performance very closely in order to ensure that the bot continues to perform as expected. There is always room for improvement, from tweaking parameter settings to fine-tuning your original strategy.

Diversification is key

Remember what we said above about diversification? Rather than a sink or swim approach to trading, you should aim for smooth sailing (at least as smooth as possible given cryptocurrency volatility).

According to Stefan Harring, ‘It is of no use if we have 20 different coins in our universe but they all produce the same signals. In that case, the most optimal solution would be to trade only one coin. What we want is that our individual signals display a low correlation, providing us with a diversified return profile and a smoother, more consistent equity curve.’

Makes perfect sense to us and it should make sense to you, too.

How to Rent the Best Crypto Trading Bots

If creating your own crypto trading bot sounds too complicated, or if you're a Python coder short on time, then the next best thing is to rent the most advanced trading bots on a trusted marketplace. Rather than spending time creating and optimizing your automated trading strategy, why not let an expert do the heavy lifting for you?

Trality's Bot Marketplace

Trality’s Marketplace is a unique space that brings together crypto trading bot creators and investors for mutually beneficial purposes. Unlike other platforms with anonymous bot makers and unproven bots, Trality’s Marketplace is a carefully curated space with hand-picked creators and the best bots available.

Access bots that outperform the market

Investors, now you can rent profitable bots tailored to your specific risk tolerances (low, medium, and high) and individual investment goals. A full suite of metrics is available, allowing you to decide on a bot based on clear, quantifiable data.

Receive updates in real time whenever changes are made to a bot Should a bot underperform, you have the ability to unfollow it at any time and select another bot.

Key metrics used when selecting bots for the Marketplace include risk-adjusted return, minimum trading activity, and time under water. And since the crypto market is a volatile one, all bots are backtested in different market conditions such as bull, bear and sideways market regimes to ensure consistent returns.

It’s this uncompromising commitment to a transparent bot evaluation process that distinguishes Trality’s Marketplace from generic, black-box alternatives.

Choosing the Right Trading Strategy

With more people beginning to trade crypto, there are now more ways to make (or lose) your hard-earned money, which is why it’s important to understand the different types of crypto trading bots (and which ones to avoid as a beginning trader). Whether arbitrage bots, coin lending bots, margin trading or leverage bots, and market maker bots, traders have an array of approaches at their disposal. Here are a few to keep in mind as a beginner trader.

Swing trading

Swing trading involves trying to profit from price fluctuations that occur over a short or medium term such as a few days or weeks. Given the inherent volatility of cryptocurrencies, the use of swing trading bots has proven to be an attractive, though difficult to master, strategy for many traders.

Swing trading generally includes technical analysis (studying statistical trends involving price and volume) and fundamental analysis (determining whether an asset is over- or under-valued) as well as a sound understanding of risk/reward ratio when considering when to enter and exit a trade (i.e. stop loss and profit targets).

Swing traders make use of technical indicators, which are either leading or lagging. Examples of momentum indicators include Relative Strength Index (RSI), Stochastic Oscillator, and On-balance volume (OBV), while Moving Average Convergence Divergence (MACD) and Bollinger Bands (BB) are good examples of a trend indicator and volume indicator, respectively.

For more information about swing trading, take a look at our in-depth article “Best indicators for swing trading.”

Day trading

Unlike swing trading, day trading involves the buying and selling of assets on the same day. The keyword here is volatility, which can be a double-edged sword. Play your cards right and you stand to make a bundle via day trading, but you can easily lose your shirt with just a few missteps.

Day trading bots can simplify your trading life by relieving some of the need and stress of sitting in front of a computer throughout the day. And since bot trading is emotionless, it can also mitigate some of our psychological handicaps, such as FOMO or fear of missing out.

Since day traders attempt to profit from volatility, the focus is on volume and liquidity, which is why technical analysis prevails (e.g. identifying entry and exit points for trades). Day traders will also make use of chart patterns and technical indicators. To determine whether or not day trading is worthwhile for you, check out our post “Is day trading crypto worth it?”

Scalping

While day trading is one specific trading strategy, there are a number of subtypes, one of which is scalping. A popular short-term trading strategy, traders who use scalping attempt to profit from small price movements, which can yield significant returns.

Unlike swing traders, scalpers look to exploit short-term volatility as opposed to larger price fluctuations, which necessarily requires a thorough understanding of market mechanics as well as quick thinking and even quicker decision-making skills. Scalpers generally trade in lower time frames, with intraday charts that vary between 1-hour, 15-minute, 5-minute, or even the 1-minute.

Buy and hold

Although not considered a real strategy, “buy and hold” deserves mention as it can be a passive approach used by many traders. As its name suggests, traders simply buy large amounts of a given asset and hold it for a long period of time.

If you buy to hold, then you’re not really benefiting from the power of algorithmic trading, as you are not actively trading. Entry price points, technical indicators, and timing become largely irrelevant. You’re merely sitting on an asset in the hope that it appreciates over an extended period of time.

Final Thoughts on Crypto Trading Bots

In a world otherwise dominated by automation, private investors are still stuck between inflexible and manual investment options. For the former, they are usually presented with index-based investment options such as ETFs or Robo-Advisors. While not inherently bad options, they leave the investor completely market-dependent.

Trality is the platform for automated investing that offers a true two-sided Marketplace. We offer intricate tools for strategy creation and make these strategies available to everyone on the Trality Marketplace.

Disclaimer: The above article is merely an opinion piece and does not represent any kind of trading advice or suggestions on how to invest, how to trade, or in which assets to invest! Always do your own research before investing and always (!) only invest what you can afford to lose!