Best Crypto Margin Trading Exchanges

MORITZ PUTZHAMMER

15 November 2022 • 11 min read

Table of contents

By now, most of us are familiar with how to lose money during a crypto bear market, but there are many ways to actually profit during the current market doldrums, with one of the best being crypto margin trading.

By using the power of leverage, margin trading allows you to buy and sell more crypto than your existing capital would allow. You effectively borrow funds from the exchange in order to make the trade. The obvious upside is that, if successful, your leveraged position will yield far greater profits, but the inverse can also occur, namely significant losses. However, there are many safeguards in place, such as a stop-loss order, that offer a measure of security against this increased exposure.

You might think that the difficult work is over as soon as you’ve understood the finer points of margin trading versus leverage trading, but the next step necessarily involves choosing a crypto margin trading platform on which to trade. With so many choices available and the recent implosion of FTX (not to mention the FUD around Crypto.com), which one is the best and, more importantly, safest?

In the following article, we explore our top five picks for crypto margin trading exchanges as well as take a brief look at a handful that didn’t quite make the cut (but are nevertheless worth mentioning). Our criteria? Leverage amount, fees, reputation, reviews, and geographic availability (US-based traders will be especially interested).

Let’s get to it!

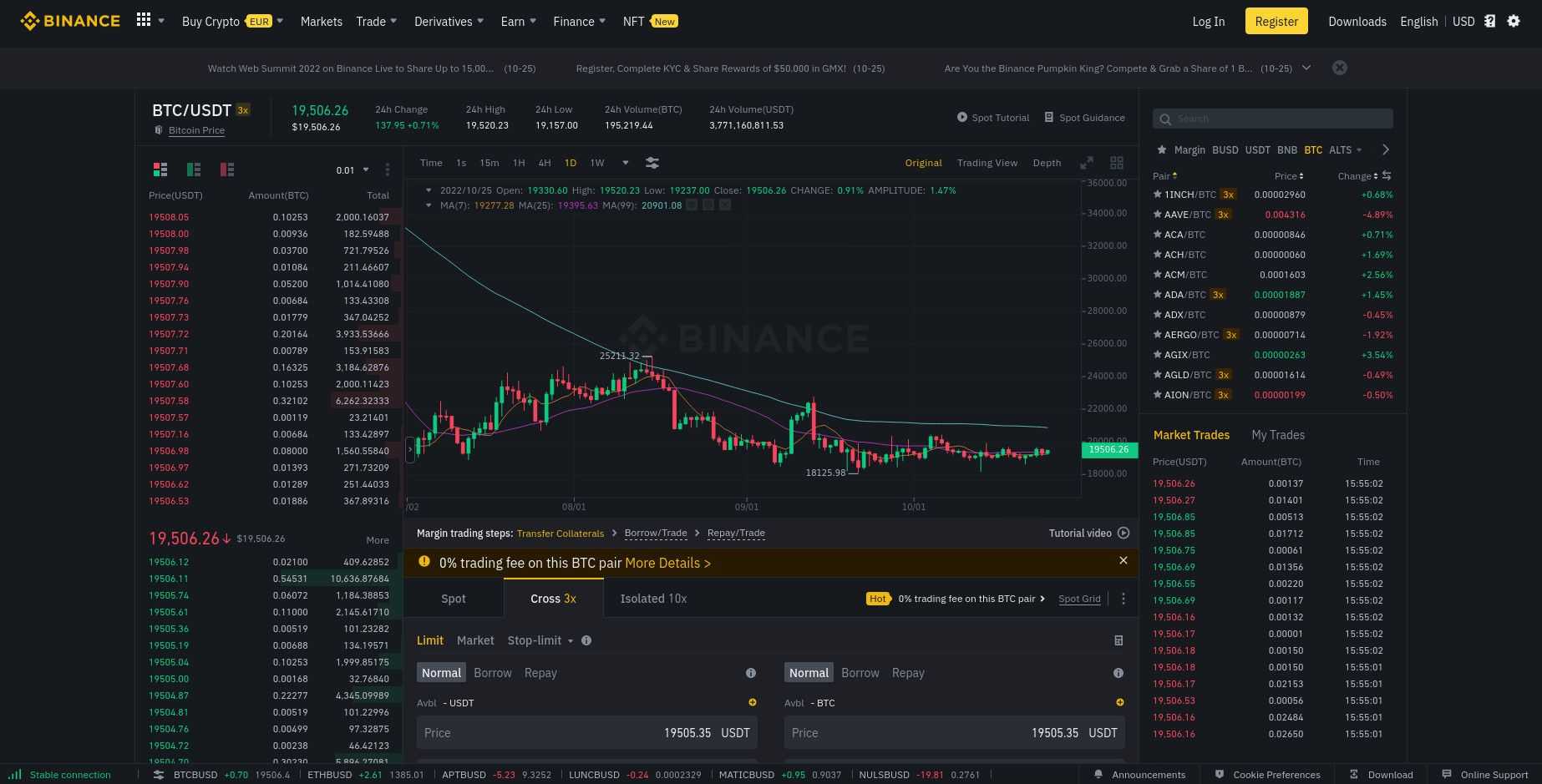

Binance Margin Trading

Binance is a top choice among traders of all experience levels and for good reason. It is the world’s largest cryptocurrency exchange by daily trading volume and boasts approximately 30 million users. It also has the highest liquidity in the market, making it an excellent choice for margin trading.

Traders can take advantage of up to 10x leverage, which is lower than some exchanges, but far from a deal breaker given the fact that Binance is such a feature-rich exchange. If you’re interested in derivatives trading, then you can use 125x margin. Cross and isolated margin are both available, although cross margin trading on Binance allows for only 3x leverage.

Your first port of call with Binance and margin trading should be their helpful Binance Margin Trading Guide, which has all of their exchange-specific information to get you started quickly and easily, including how to open a Binance margin trading account, transfer and borrow funds to margin level and actually trading on margin. Then check out their FAQs for Spot and Margin Trading for a deeper dive into their trading rules and limits, info on market makers and market takers, and stop-limit (otherwise known as a stop-loss) function, among other things.

Binance Futures margin trading

If you’re interested in futures trading, then check out Binance Futures, which is a derivatives-based exchange initiated by Binance in 2019. As the name suggests, futures trading involves borrowing in order to make predictions on future price movements of your chosen cryptocurrencies, which differs from margin trading (i.e., trading spot assets).

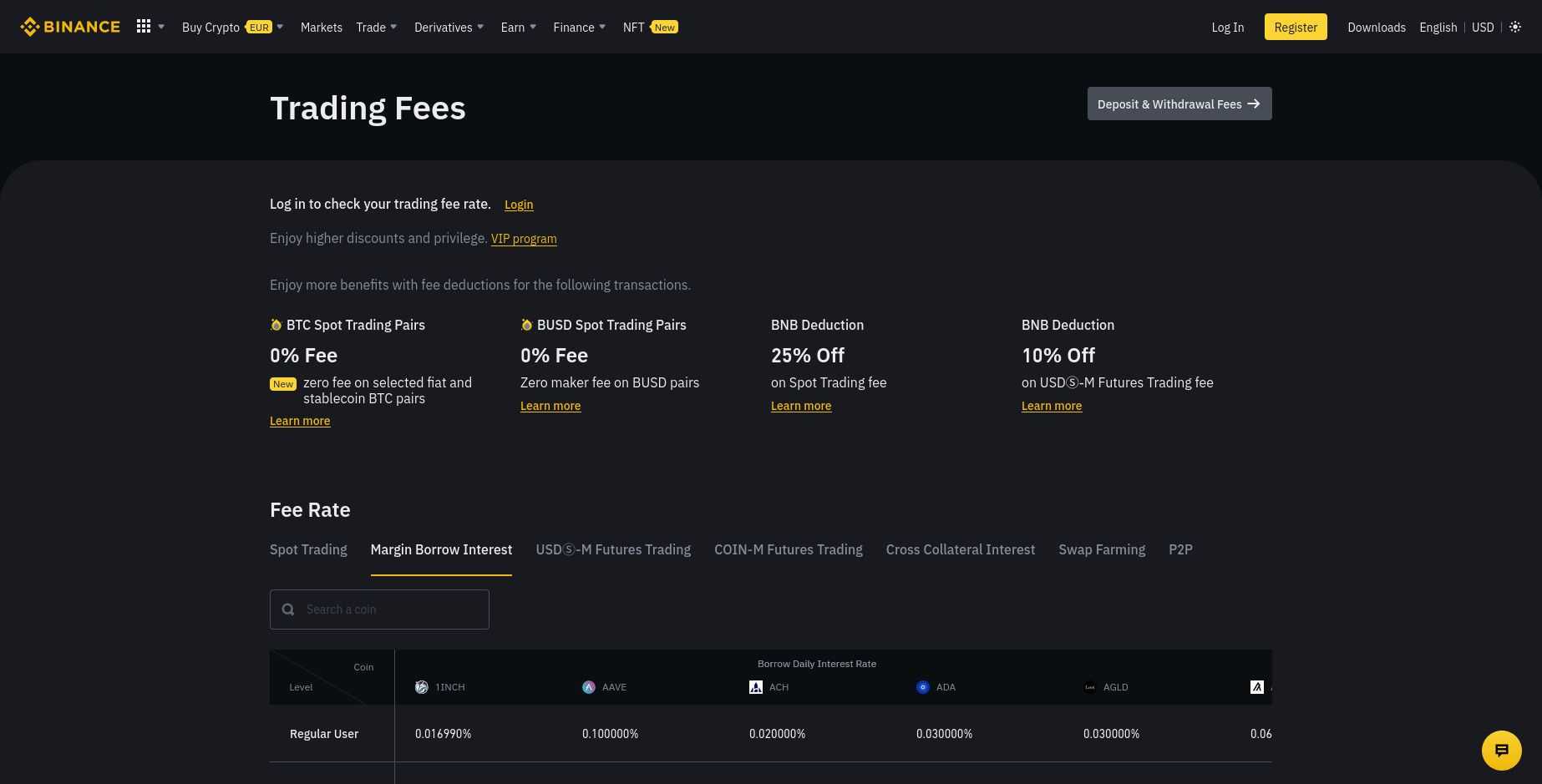

The fees for Binance Futures is structured in tiers according to 30-day trading volume, with maker fees starting at 0.02% and take fees starting at 0.04%. Spot trading fees are higher (0.1% for maker and taker), but Binance does offer a 25% discount if traders hold and use BNB to pay their trading fees. Keeping in mind those decimal places, daily interest for funds that have been borrowed are 0.004% to 0.04%.

Binance margin trading fees at a glance

Margin trading fees on Binance vary based on a number of factors.

Check their Trading Fees page for the latest information about their fee rate for things like spot trading, margin borrow interest, and futures trading as well as for specific deductions and their VIP program.

Kraken Margin Trading

Founded way back in 2011 (we’re talking ancient for the crypto space), Kraken is a US-based crypto exchange that is one of the largest and oldest Bitcoin exchanges in the world, making it among the most trusted crypto exchanges globally. And since it’s licensed in the US market, it’s one of the few exchanges that can offer margin trading to US-based traders.

Traders interested in margin trading crypto can take out long or short positions with Kraken using up to 5X leverage. Kraken also has low rollover fees, with its users never having to pay more than 0.02% (per 4 hours) in fees, along with high margin limits—eligible traders can access up to $500,000.

As with Binance, Kraken takes great pains to provide its users with a range of educational information related to margin trading, whether it deals with Margin Trading Terms and Concepts and a simple How to Trade Using Margin or a more advanced feature such as the differences in spot trading with and without the use of margin.

Kraken also offers Bitcoin futures trading with leverage, and their new margin mode functionality allows traders to use isolated margin to limit downside per contract (or take advantage of cross margin to use all of one’s collateral across all positions).

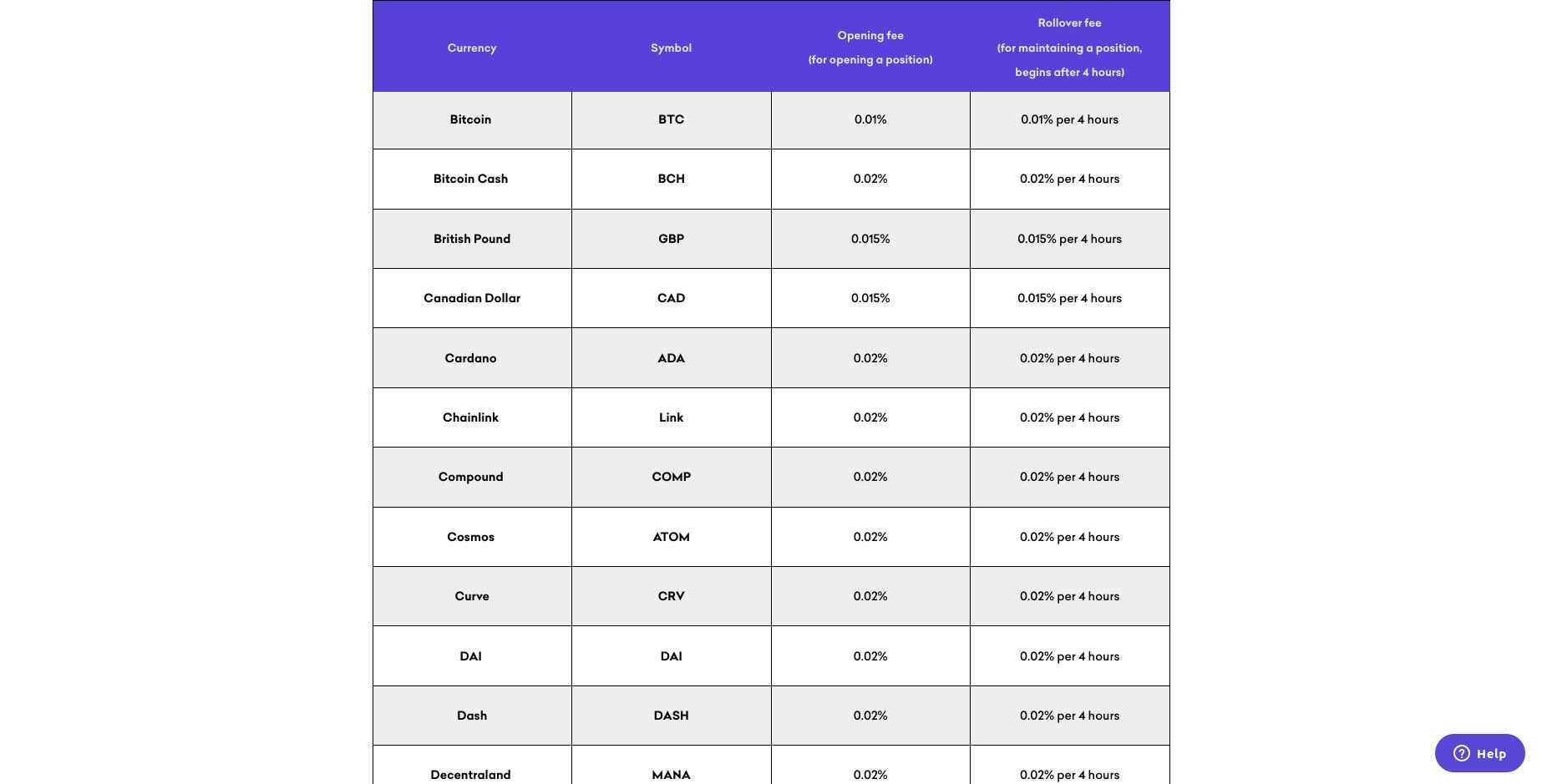

Kraken margin trading fees at a glance

Traders are encouraged to check their site for the latest fee structure, although the following can serve as a basic guide:

“In addition to the margin fees (opening and rollover), the usual trade fee will be applied to the opening and closing volume of a spot position on margin (but there is no fee for settling a spot position on margin). Margin fees are charged based on the total value of the amount that is extended as margin to effect the margin trade. Collateral also held in the account is not deducted from that amount.”

Kraken’s website is the best source of information regarding the various fees related to margin trading, as these can be updated regularly.

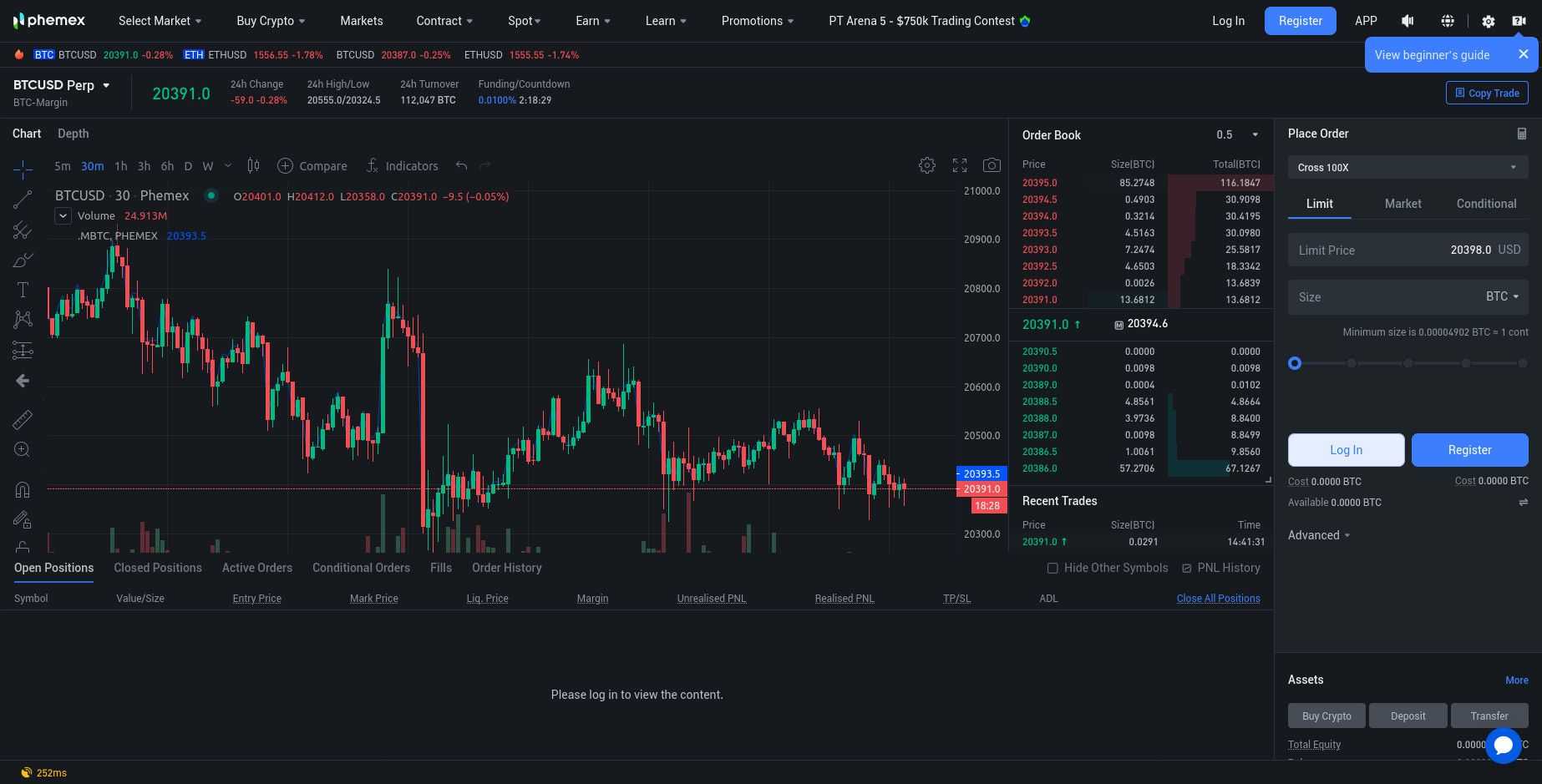

Phemex Margin Trading

Founded in Singapore in 2019 by Jack Tao, Phemex describes itself as “the most efficient crypto trading and investment platform.” Tao himself is the former global development VP of Electronic Trading (MSET) Benchmark Execution Strategies (BXS) at Morgan Stanley and his exchange has made significant strides since its inception. Phemex is among the top 10 global exchanges, with a peak trading volume in excess of $12 billion each day.

The exchange boasts 300,000 transactions per second, with order response times of less than 1 millisecond along with cold wallet storage and transfers requiring two-level human scrutiny offline signatures. In terms of margin trading with leverage, Phemex offers crypto spot markets and derivative contracts of up to 100x leverage.

One of the nicer features of Phemex is their informative blog articles, which cover a wide range of crypto trading topics, especially ones germane to margin trading on the exchange. From margin trading terms and related concepts, initial and maintenance margins, and adjusting the margin on a position to setting leverage and risk limit, among many others, there’s a wealth of well-written information at your disposal.

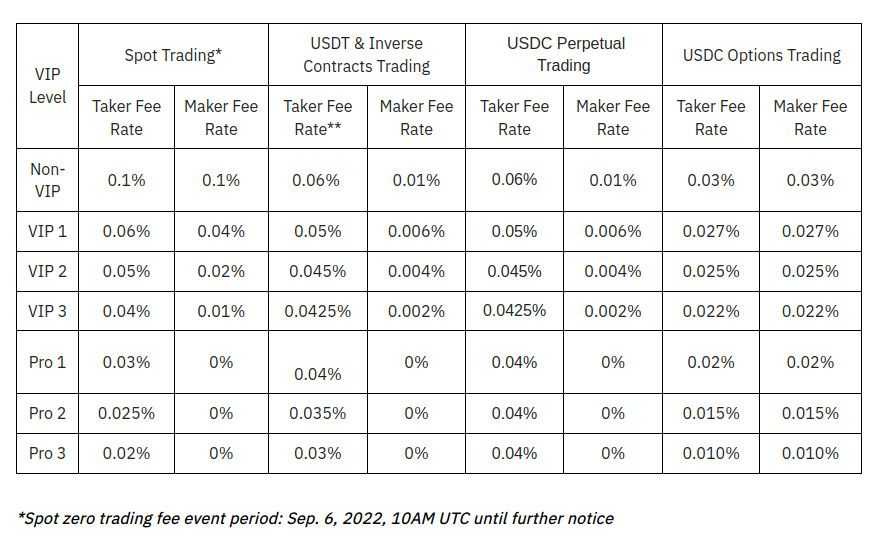

Phemex margin trading fees at a glance

As they explain on their dedicated fees page, Phemex employs a 0.01% maker fees and a 0.06% taker fee for contracts, while their maker and take fees for spot trading fees are 0.1%. And in line with other exchanges, they offer reductions for both via a VIP program.

As always, it’s best to consult Phemex’s website for the latest information regarding fees and how they are calculated.

Bybit Margin Trading

Born and raised in China (so to speak), Bybit started out in March 2018 as a little-known derivatives exchange, but has quickly transformed into a Singapore-based trading giant. With co-founder and CEO Ben Zhou at the helm, the exchange achieved a peak trading volume of $54 billion in May 2021, although it currently sits around $10 billion a day.

Whereas Binance has chosen the path of regulation, Zhou has decided on the path of least resistance: deregulation. Bybit is one of the best crypto exchanges without KYC; its users are not required to provide ID in order to trade, making it an attractive option for crypto purists.

For those interested in margin trading, Bybit has a lot to offer. If you like to live on the wild side of things, you can dabble in perpetual swaps and crypto futures with up to 100x leverage (yes, you read that correctly). To put that into perspective, if you open a position at $200, then you can use 100x leverage to trade a value of $20,000.

Bybit effectively takes a two-pronged approach to margin trading: cross margin and isolated margin, with cross margin being its default mode for this type of trading. In this case, a trader’s balance is used to prevent liquidation; if the equity is lower than the maintenance, then the trader’s position will be liquidated. Isolated margin, on the other hand, does exactly what it suggests, isolating the initial margin in a position from the trader’s available balance so that only the initial margin can be lost should the trader’s position be liquidated.

As Bybit explains in their documentation,

"Cross margin has a lower risk of liquidation than isolated margin and a lower margin requirement, but unlike isolated margin, it doesn’t have an option for adjustable leverage. The leverage in cross margin mode is determined by the position size and available margin. However, traders who take higher leverage in isolated margin mode will see their positions have the higher potential of being liquidated.”

Traders looking for longer positions or crypto arbitrage will most likely be interested in cross margin, while speculative traders will opt instead for isolated margin trading. Bybit even features its so-called “Auto-Margin Replenishment” (AMR) tool, allowing traders using isolated margin in USDT to add margin to their positions automatically, thereby avoiding liquidation. And if you’re wondering whether you can switch between cross and isolated margin on an open position, you can.

Bybit margin trading fees at a glance

As always, the most important source of truth regarding a respective exchange’s trading fees will be the exchange itself, as these fees can be updated. Nevertheless, let’s look at Bybit’s current margin trading fees below.

As is customary with many exchanges, Bybit adheres to a fee model based on maker fees and taker fees based on whether a user is a non-VIP trader or a VIP trader.

For derivatives trading, Bybit’s taker fee is 0.06% while its maker fee is 0.01%. For more information regarding their fee structure, consult their Trading Fee Structure page.

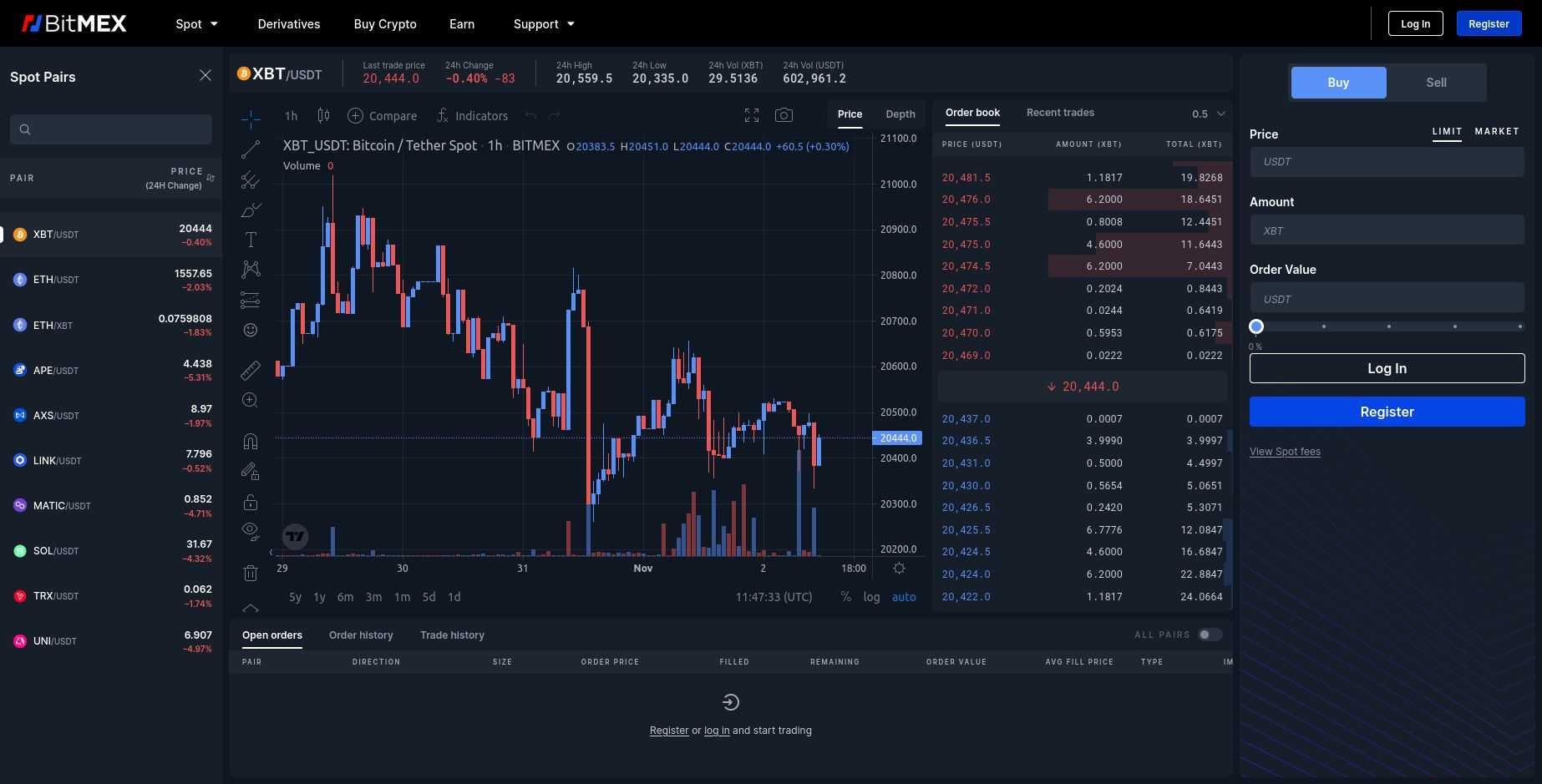

BitMEX Margin Trading

Based in the Seychelles and founded in 2014, BitMEX bills itself as “the most advanced crypto trading platform for Bitcoin.” While we here at Trality HQ are often wary of superlatives, what we can say is that Bitmex is a peer-to-peer margin trading platform offering leveraged contracts, which can be bought and sold in crypto. Crucially, the exchange does not handle fiat.

If you’re a margin trader looking for a large amount of leverage, then Bitmex offers you 100x just like Bybit. And similar to Binance and Bybit, among others, Bitmex offers both cross margin and isolated margin. In fact BitMEX is something of an OG when it comes to crypto margin trading exchanges. You’ll often see it referred to as the “longest running leverage trading exchange.”

However, BitMEX does not provide its users with a portfolio margin. As it explains in its overview of isolated and cross margin,

“Unrealised profit may not be used to offset any unrealised losses, or as margin to open new positions. This is especially important for those traders who intend to trade the spread between two derivative contracts that share the same underlying. You must realize your profit by closing a position in order for it to be used to offset losses on another contract.”

At the moment, users can trade BTC/USD, ETH/USD, ADA, BCH, EOS, LTC, TRX, and XRP for short or long positions with a stop-loss order to prevent a liquidation. Potential users might also be interested in learning more about how to adjust leverage and add margin to a position while using BitMEX.

And a special note to US-based traders: BitMEX is available worldwide, excluding the United States.

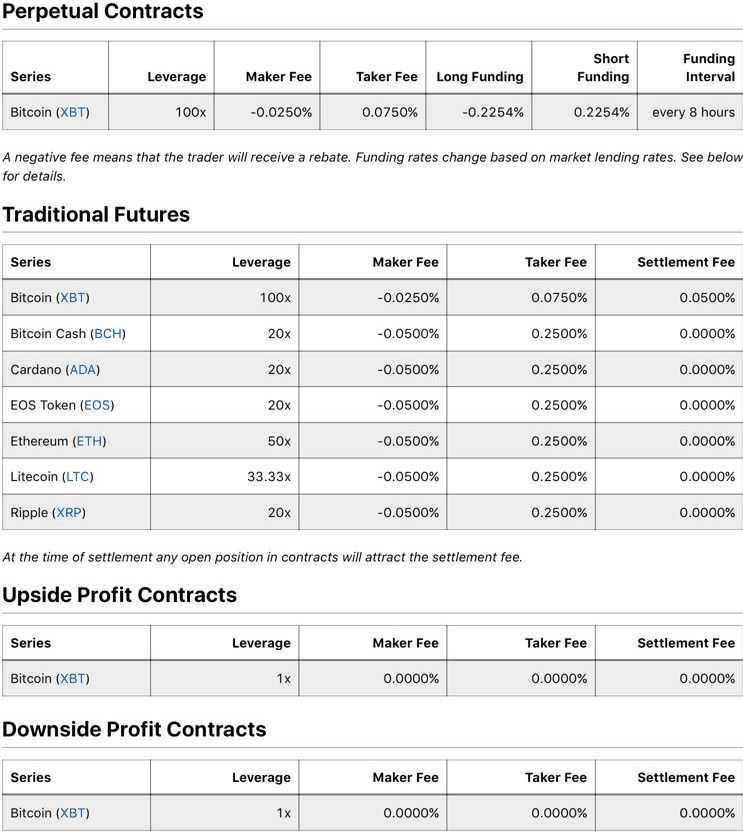

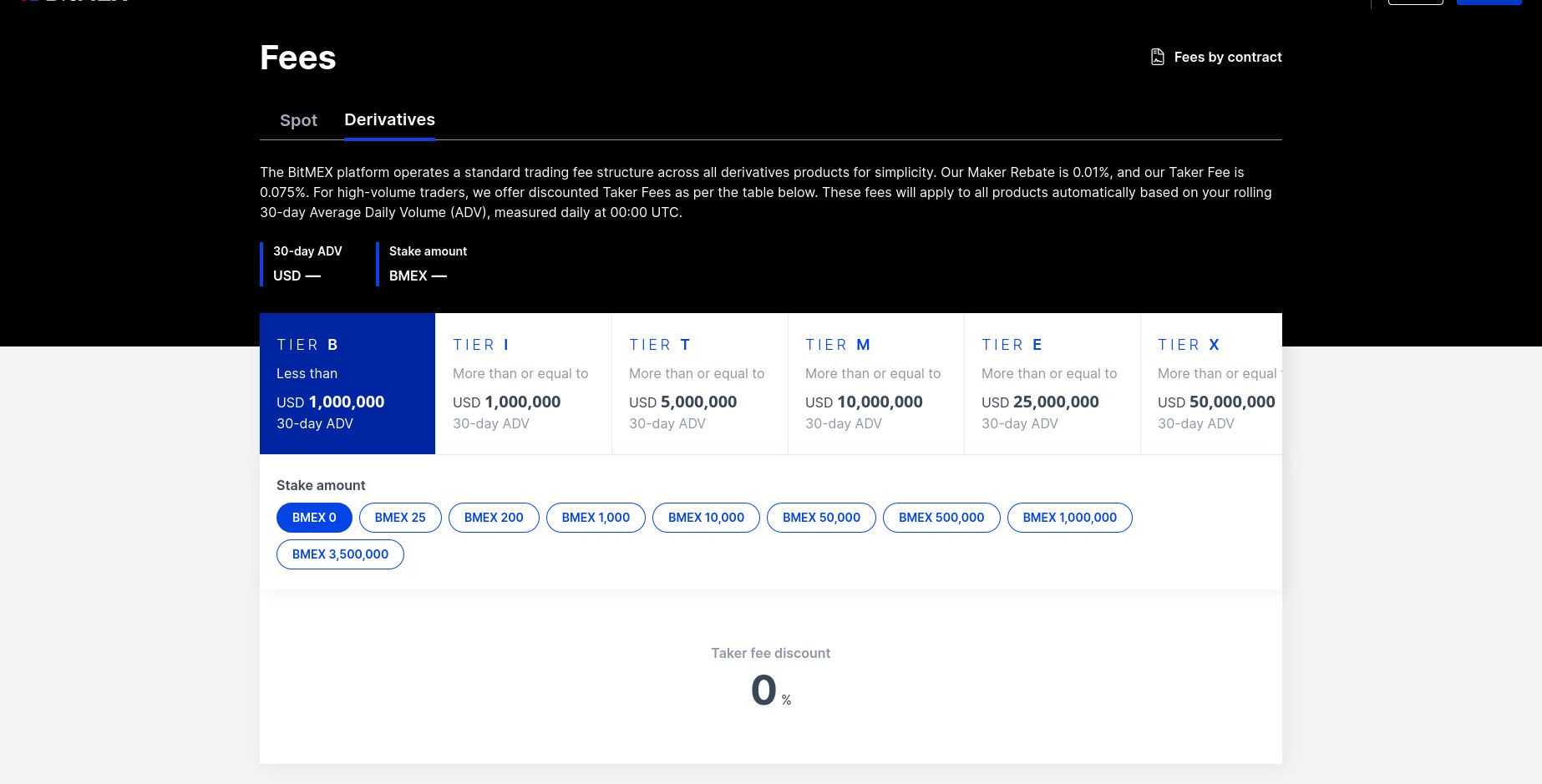

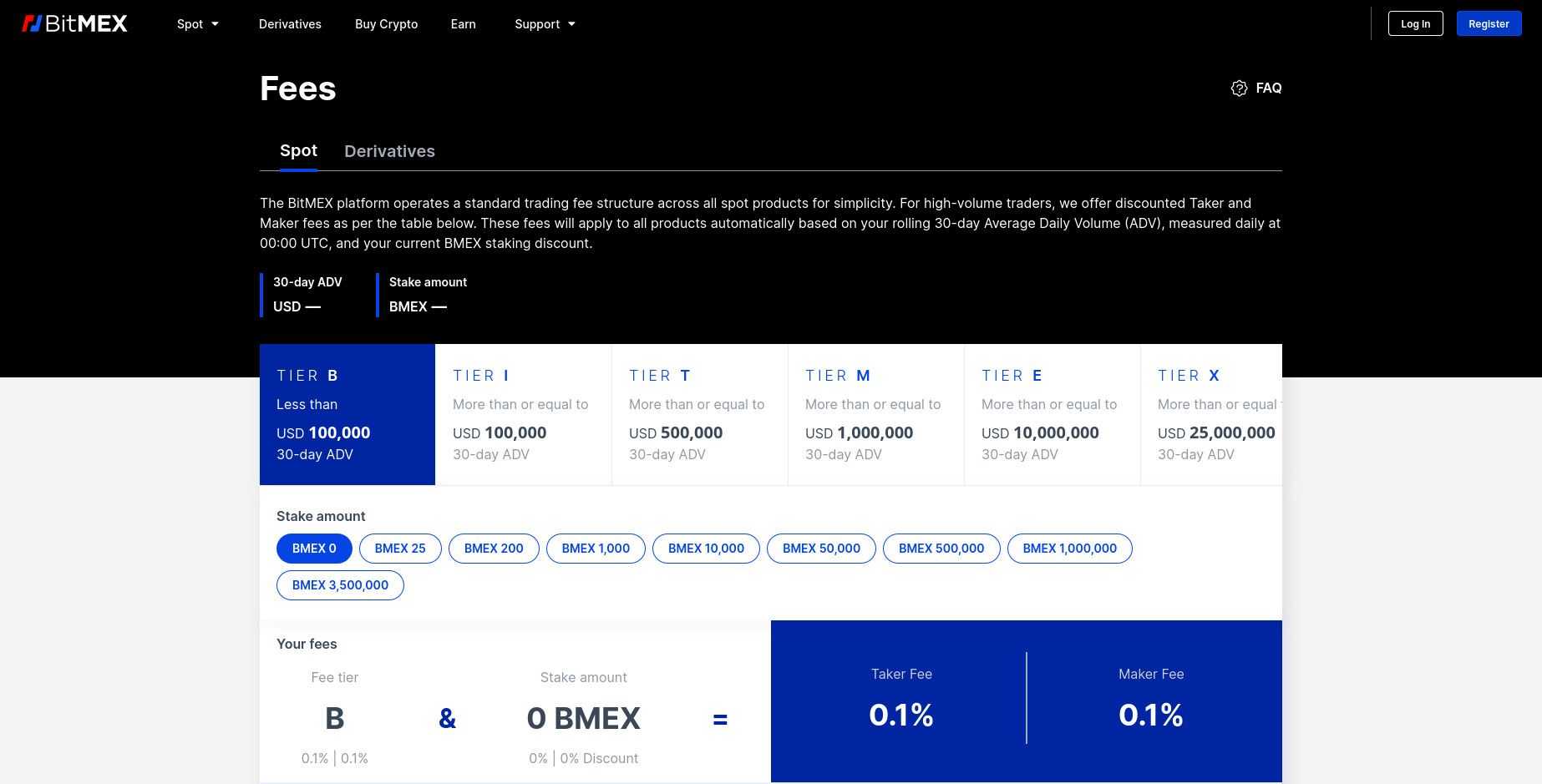

BitMEX margin trading fees at a glance

In order to simplify their fee structure, BitMEX has adopted a standardized approach.

For example, on derivatives their maker fee is 0.01% and their taker fee is 0.075%. Spot trading fees will vary depending on average daily volume (ADV).

Spot trading fees will vary depending on average daily volume (ADV).

It should be noted that deposits and withdrawals on BitMEX are free, making BitMEX an attractive option for margin traders, if not the absolute best one.

Crypto Margin Trading Exchanges: Honorable Mention

The above crypto margin trading exchanges are some of the best for many of the reasons that we’ve outlined, but there are others worth considering. Let’s take a brief look at some of the ones that didn’t quite make the cut.

KuCoin margin trading

KuCoin is an excellent crypto exchange in many respects, but it does have an achilles heel: inconsistent user reviews. As Investopedia reports, “KuCoin’s user reviews are especially poor. Reviewers report problems with withdrawals, customer service, and issues with market manipulation.” In our opinion, this raises red flags, but it certainly shouldn’t dissuade anyone from exploring Kucoin’s many offerings.

Established in 2017, KuCoin offers a wide selection of pairs with which to margin trade (over 220 pairs) with up to 10x leverage. For those interested in futures, you can trade over 100 coins with up to 100x leverage. And their Trading Fees page contains comprehensive information regarding their fee structure.

PrimeXBT margin trading

First launched in 2019, PrimeXBT has established itself in just a few years as a crypto exchange to be taken seriously when it comes to margin trading. With its sophisticated margin trading engine and charting platform, users have access to a range of crypto margin trading tools with multiple charts and asset views across various timeframes, which comes in handy when tracking more than one asset at a time.

With leverage up to 100x, PrimeXBT is one among a number of crypto exchanges offering a large amount of leverage. Margin fees on PrimeXBT for buy and sell orders are 0.5% for each transaction, and there is also something called an “overnight finance fee” for positions that are not opened and closed on the same trading day.

Final Thoughts

For the vast majority of crypto margin traders, Binance offers the best of all possible worlds.

For US-based traders, there are relatively few options available, though. Kraken does offer margin trading to users based in the United States and Canada, although Intermediate and Pro clients on the exchange must meet certain eligibility requirements.

For margin traders seeking an exchange without KYC, then ByBit should be at the top of your list.

And since no list can ever be an absolutely exhaustive one, there are bound to be omissions, such as Margex, CEX.io, StormGain, Derbit, and possibly Huobi.

All in all, margin traders are spoilt for choice when it comes to the best crypto margin trading platforms. But, with so many options available, it’s imperative to do your own research, understand the respective fee structures of each exchange, and familiarize yourself with key features in order to pick the right one to achieve your trading goals.